I appreciate your point of view, and I'd bet a lot of people in Canada would agree. The problem is some(maybe many) of these payouts are mandated by the courtsI am sympathetic to First Nations peoples; but I'm certain you have bad actors within that embezzle funds meant for the public good for themselves.

You have similar bad actors within Unions, and Corporations, and Governments. It's human nature and taxpayers should want value and accountability for their money.

We can't just hand out money for the sake of it; we did that during COVID and there was an inevitable amount of fraud and waste.

Canada Federal deficit at $61.9B for 2023-24, Freeland resigns.

- Thread starter DesRicardo

- Start date

by not knowing what you are doingHow the hell do you blow past your own guardrail by 50%?

i bet Trudeau does not know how many people are employed by the govt +/- 100,000

i bet Trudeau does not know how much is currently being spent on outside contractors +/- 1$B

i bet Trudeau does know how exactly much is currently being spent on political gimmicks +/- 1 MM

i bet Trudeau does know how exactly much is currently being funneled to environmental NGOs +/- 1 MM

Gerald Butts will text him the funnel amount once a month

i bet Trudeau did not bother to read the last budget update presented to parliament

he just asked Freeland to give him the Coles notes version.

steven Harper would have known all the above and a whole lot more and known all of those values without needing notes

he will likely say funds are available when you can show how they are being spentI'm interested to see how PeePee deals with these.

if a payout is mandated by the courts, there will be a specific objective for the payoutI appreciate your point of view, and I'd bet a lot of people in Canada would agree. The problem is some(maybe many) of these payouts are mandated by the courts

it is only reasonable the recipient of the funds show how the funds were spent to achieve the objective

I am sympathetic to First Nations peoples; but I'm certain you have bad actors within that embezzle funds meant for the public good for themselves.

You have similar bad actors within Unions, and Corporations, and Governments. It's human nature and taxpayers should want value and accountability for their money.

We can't just hand out money for the sake of it; we did that during COVID and there was an inevitable amount of fraud and waste.

Trudeau has increased the size of the federal govt by 43% since 2015

note how the size of govt had been declining gradually and responsibly prior to 2015

now with that many new employees at his disposal one might expect he could get more done.

but no

in 2022

The black hole of public service contract spending

An estimated $15 billion was spent on outsourcing last year alone, yet the public service is also growing in leaps and bounds. Question for MPs: Why?

The black hole of public service contract spending

The budget will balance itselfAn estimated $15 billion was spent on outsourcing last year alone, yet the public service is also growing in leaps and bounds. Question for MPs: Why?

Last edited:

CERB would have been expensed in 2020/ 2021Apparently a lot of that is due to pandemic related benefits and loans (CERB and CEBA) paid to ineligible persons and companies which the CRA never expects to collect on.

the pandemic as an excuse for irresponsible spending has been used for long enough

accountants please correct me if i am wrongApplicants received $2,000 for a 4-week period (the same as $500 a week), between March 15 and September 26, 2020. The last day to apply was December 2, 2020.

CEBA accounting would be more complicated, however the cash outlay would have been in 2020

the only way CEBA would become a significant current budget overage is if a whole pile of govt loans to business became non performing since the last budget update.

if that is the case the Canadian economy is in deep deep trouble

this $ 62 Billion is fresh irresponsible spending on a bloated govt without any tangible benefit for the average Canadian and a whole lot of interest on Justin's irresponsible borrowingThe federal government and provinces are expected to spend $81.8 billion on interest payments in 2023/24, with the federal government spending $46.5 billion on debt servicing charges.

Justin Trudeau: the Budget will balance itself

Reality : No it will not

Last edited:

Damn, why is Canada expected to reduce its debt more intensely than other G7 Nations?

DEBT

Government Debt Projections for G7 Countries (2024-2029F)

Published

3 months ago

on

September 25, 2024

By

Kayla Zhu

Article/Editing:

Graphics/Design:

See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

USE THIS VISUALIZATION

Government Debt Projections for G7 Countries (2024-2029F)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

On Sept. 18, 2024, the U.S. Federal Reserve reduced its benchmark interest rate by half a percentage point to a range of 4.75% to 5%. This move is expected to decrease short-term borrowing costs, including those for U.S. government debt.

When the Fed lowers the federal funds rate, it generally leads to lower rates on Treasury bills and other short-term government securities, which in return reduces its borrowing costs on newly issued short-term debt. While this reduction in rates will help reduce debt-servicing costs, the U.S. is still projected to see the biggest increase in its gross debt of all G7 nations over the next five years.

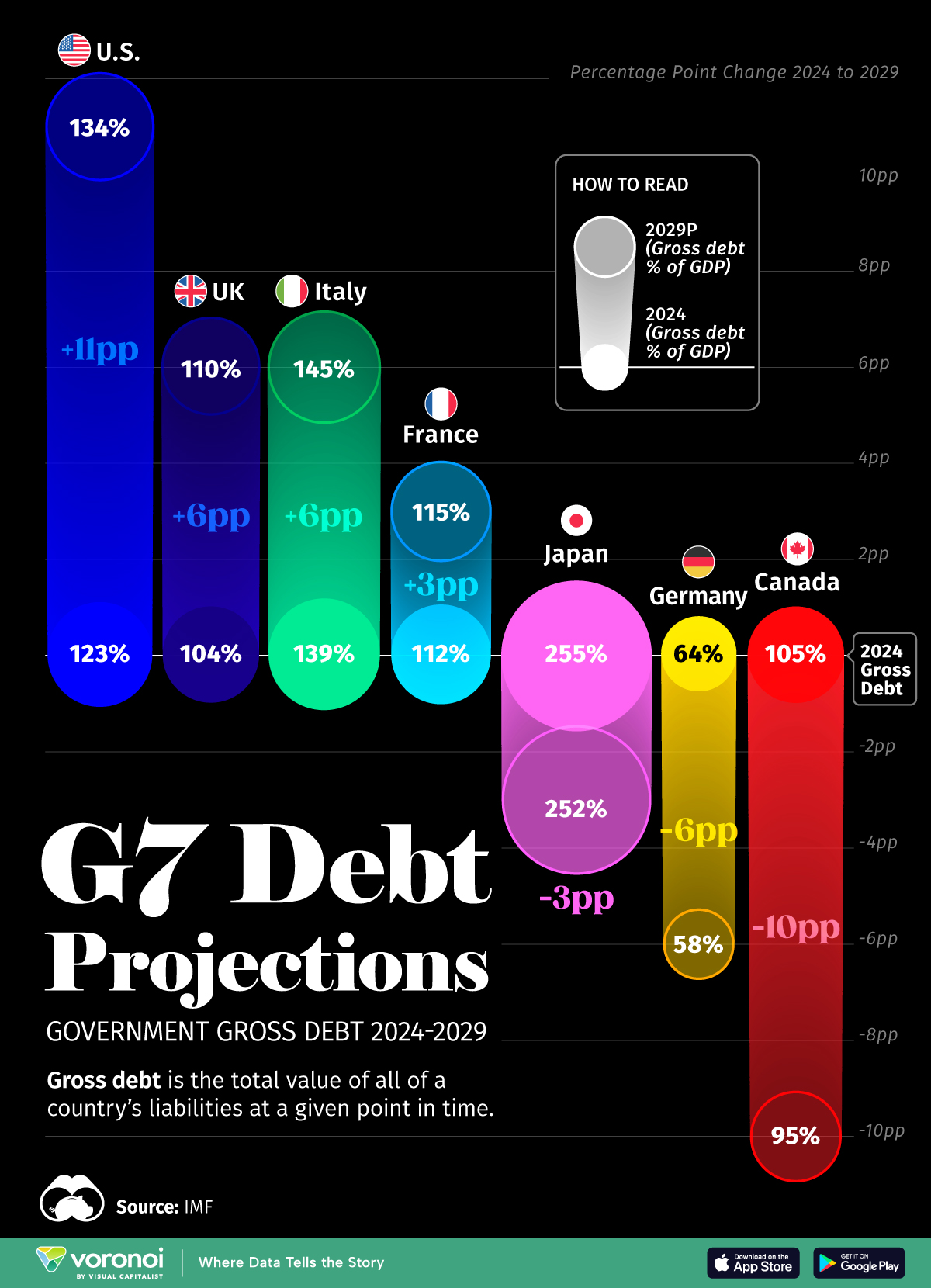

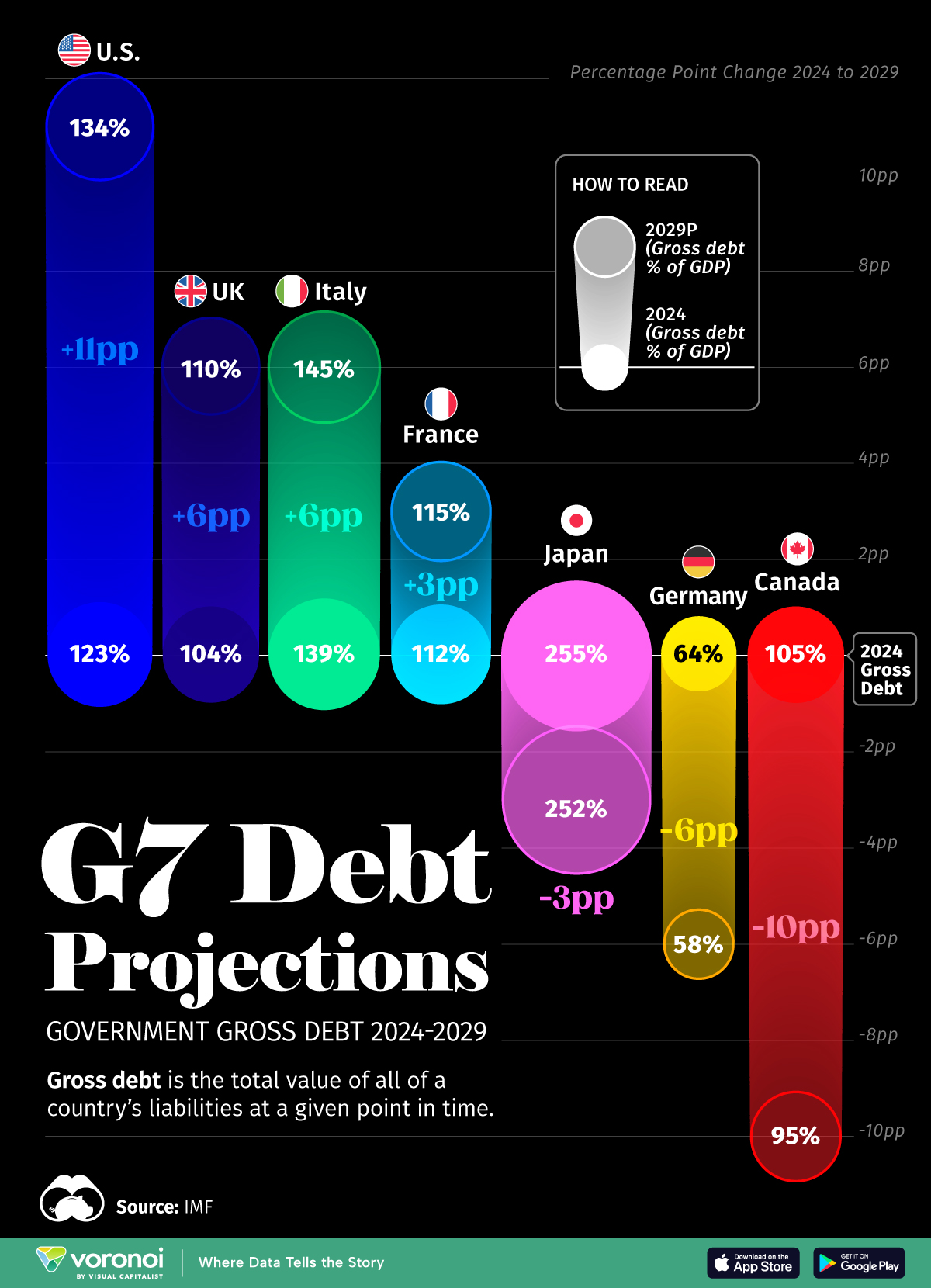

This graphic uses data from the International Monetary Fund’s (IMF) April 2024 edition of the World Economic Outlook to show how the U.S. stacks up against its G7 counterparts in terms of projected gross debt as a percentage of GDP in 2024, and how debt is forecasted to change by 2029.

Methodology: Defining Gross Government Debt

Gross debt is the total value of all of a country’s liabilities at a given point in time. Net debt is gross debt less a country’s financial assets, including cash reserves or investments. The debt figures in this infographic are of government debt, and don’t include public sector debt from provincial or state-level debt.

For more data on global debt, the IMF’s Global Debt Database features datasets of both public and private debt, broken down into more detailed categories.

Which G7 Countries Are Projected To Grow Their Debt?

Below, we show the gross government debt projections (as a share of GDP) for G7 nations from 2024 to 2029.

DEBT

Government Debt Projections for G7 Countries (2024-2029F)

Published

3 months ago

on

September 25, 2024

By

Kayla Zhu

Article/Editing:

Graphics/Design:

USE THIS VISUALIZATION

Government Debt Projections for G7 Countries (2024-2029F)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

On Sept. 18, 2024, the U.S. Federal Reserve reduced its benchmark interest rate by half a percentage point to a range of 4.75% to 5%. This move is expected to decrease short-term borrowing costs, including those for U.S. government debt.

When the Fed lowers the federal funds rate, it generally leads to lower rates on Treasury bills and other short-term government securities, which in return reduces its borrowing costs on newly issued short-term debt. While this reduction in rates will help reduce debt-servicing costs, the U.S. is still projected to see the biggest increase in its gross debt of all G7 nations over the next five years.

This graphic uses data from the International Monetary Fund’s (IMF) April 2024 edition of the World Economic Outlook to show how the U.S. stacks up against its G7 counterparts in terms of projected gross debt as a percentage of GDP in 2024, and how debt is forecasted to change by 2029.

Methodology: Defining Gross Government Debt

Gross debt is the total value of all of a country’s liabilities at a given point in time. Net debt is gross debt less a country’s financial assets, including cash reserves or investments. The debt figures in this infographic are of government debt, and don’t include public sector debt from provincial or state-level debt.

For more data on global debt, the IMF’s Global Debt Database features datasets of both public and private debt, broken down into more detailed categories.

Which G7 Countries Are Projected To Grow Their Debt?

Below, we show the gross government debt projections (as a share of GDP) for G7 nations from 2024 to 2029.

| Country | Gov't gross debt 2024 (Share of GDP) | Gov't gross debt 2029F (Share of GDP) | Change |

|---|---|---|---|

| 254.6% | 251.7% | -2.9 pp |

| 139.2% | 144.9% | +5.7 pp |

| 123.3% | 133.9% | +10.6 pp |

| 111.6% | 115.2% | +3.6 pp |

| 104.7% | 95.4% | -9.3 pp |

| 104.3% | 110.1% | +5.8 pp |

| 63.7% | 57.7% | -6.0 pp |

Isn't that what musk lost on Twitter within months of buying it or like 1000 times less what Trump lost while 'leading' America ?

It's funny how the GOP. Kept it so secret who got the money. How many billions did trump get ???Damn, why is Canada expected to reduce its debt more intensely than other G7 Nations?

DEBT

Government Debt Projections for G7 Countries (2024-2029F)

Published

3 months ago

on

September 25, 2024

By

Kayla Zhu

Article/Editing:

Graphics/Design:

See this visualization first on the Voronoi app.

USE THIS VISUALIZATION

Government Debt Projections for G7 Countries (2024-2029F)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

On Sept. 18, 2024, the U.S. Federal Reserve reduced its benchmark interest rate by half a percentage point to a range of 4.75% to 5%. This move is expected to decrease short-term borrowing costs, including those for U.S. government debt.

When the Fed lowers the federal funds rate, it generally leads to lower rates on Treasury bills and other short-term government securities, which in return reduces its borrowing costs on newly issued short-term debt. While this reduction in rates will help reduce debt-servicing costs, the U.S. is still projected to see the biggest increase in its gross debt of all G7 nations over the next five years.

This graphic uses data from the International Monetary Fund’s (IMF) April 2024 edition of the World Economic Outlook to show how the U.S. stacks up against its G7 counterparts in terms of projected gross debt as a percentage of GDP in 2024, and how debt is forecasted to change by 2029.

Methodology: Defining Gross Government Debt

Gross debt is the total value of all of a country’s liabilities at a given point in time. Net debt is gross debt less a country’s financial assets, including cash reserves or investments. The debt figures in this infographic are of government debt, and don’t include public sector debt from provincial or state-level debt.

For more data on global debt, the IMF’s Global Debt Database features datasets of both public and private debt, broken down into more detailed categories.

Which G7 Countries Are Projected To Grow Their Debt?

Below, we show the gross government debt projections (as a share of GDP) for G7 nations from 2024 to 2029.

Country Gov't gross debt 2024

(Share of GDP)Gov't gross debt 2029F

(Share of GDP)Change

254.6% 251.7% -2.9 pp

139.2% 144.9% +5.7 pp

123.3% 133.9% +10.6 pp

111.6% 115.2% +3.6 pp

104.7% 95.4% -9.3 pp

104.3% 110.1% +5.8 pp

63.7% 57.7% -6.0 pp

so no , the debt to GDP ratio is not going to get better

you need to keep up with current events

we just were told the Canadian Government blew through its already bloated deficit by 50%

in order to reduce debt a government needs to get to balance first

Trudeau has created a structural deficit by expanding the size of government

it takes time to shrink govt and it is very expensive (severance)

the current deficit is $62 B

$46 B is interest on federal debt

there is now way in hell the govt will get to balance by 2029In 2023/24, the federal government and provinces are expected to spend $81.8 billion on interest payments, with the federal government spending $46.5 billion on debt servicing charges.

and Canada is expect to have the slow growth in a quite optimistic forecast from the Bank of Canada

Projections

Economic growth in Canada is forecast to pick up gradually. Inflation is expected to remain around 2% as core inflation slows.

Projections

Monetary Policy Report—October 2024

this assumes no recession and no adverse trump impact on our economyOct 23, 2024 — Potential output growth in Canada is expected to slow from about 2.4% in 2024 to around 1.9% on average over 2025 and 2026, unchanged from the ...

debt growth is going to outpace GDP growth

and that difference is going to compound annually

so no , the debt to GDP ratio is not going to get better

so no there will not be a debt reduction miracle as projected by Kayla Zhu

perhaps it is high time you figure out the Trudeau / socialist experiment has caused a disaster