By-law knows it's going on but looks the other way, as there is a housing crisis and a serious shortages of rentals.And yes rooming houses and multiple rentals in most zones are def illegal but that doesn’t stop them from doing it.

Million Dollar Mortgages

- Thread starter Rose11

- Start date

Yes you are correct.By-law knows it's going on but looks the other way, as there is a housing crisis and a serious shortages of rentals.

Using housing shortage as justification for laws to be broken.

Convenient isn’t it.

That sounds like an investment property rather than someone's personal home. Places like that always existed and are everywhere, specially around Universities. it's not particular to your specific street or south Asians . The average home selling in GTA for 1.4M isn't all being rented out to students.It’s not BS, it’s happening on my old street exactly as I’m describing.

On my current street is a 5 bedroom 2 storey house being rented to 8 Indian students for $1000/mth each. Landlord raking in $8k/mth and his mortgage is more than covered.

And yes rooming houses and multiple rentals in most zones are def illegal but that doesn’t stop them from doing it.

Why do you continue to argue.That sounds like an investment property rather than someone's personal home. Places like that always existed and are everywhere, specially around Universities. it's not a peculiar to your specific street. The average home selling in GTA for 1.4M isn't all being rented out to students.

The house next to my mom is a 3 bedroom bungalow.

the basement has 3 fucking rental units commanding about $3500/mth.

upstairs main floor owner lives with his family of man wife 2 kids and mother in law.

Bengalis.

That’s the sacrifice they are willing to make in order to have a house.

They are accustomed to living on top of each other with noise and smells from cooking and not enough bathrooms.

This is going on everywhere.

Italians doing it too? Everybody in Vaughan (1.6M) and Richmond Hill (1.8M) living on top of each other with pasta cooking smells?They are accustomed to living on top of each other with noise and smells from cooking and not enough bathrooms.

This is going on everywhere.

Yes. This must be the reason how average GTA prices got to 1.5M with multiple families in a single family home paying off the mortgage. And all the news outlets forgot to cover this specifc way of living when covering the housing market. Nobody brought it up. They talked interest rates but forgot to talk about south asian basement rentals, the real reason, behind why 70% of GTA, that isn't south asian, is paying 1.5M for their houses.

When I search for properties far outside the GTA in what used to be the smaller town 1/2 price homes….they are also in the ridiculously highly priced range of well over a mill.Italians doing it too? Everybody in Vaughan (1.6M) and Richmond Hill (1.8M) living on top of each other with pasta cooking smells?

Yes. This must be the reason how average GTA prices got to 1.5M with multiple families in a single family home paying off the mortgage. And all the news outlets forgot to cover this specifc way of living when covering the housing market. Nobody brought it up. They talked interest rates but forgot to talk about south asian basement rentals, the real reason, behind why 70% of GTA, that isn't south asian, is paying 1.5M for their houses.

Have a look in collingwood/thornbury for example. $1.2-$1.5M up there too.

I really don’t think it’s a supply and demand issue. It’s greed mixed with unrealistic stupidity.

My Boss is Italian and his son and daughter teamed up to buy a house together.Italians doing it too? Everybody in Vaughan (1.6M) and Richmond Hill (1.8M) living on top of each other with pasta cooking smells?

And from what I hear Vaughan isn't as Italian as it once was. I don't know for sure because I'm not from or round there.

And renting is a very real thing. Many people are picking up homes for rent income from tenants and AirBnB.

www.yorkregion.com

www.yorkregion.com

storeys.com

storeys.com

‘A garbage dump’: Infamous York Region family allegedly scams multiple landlords

David, Jason, Vicki Small allegedly won't leave Markham landlord's Uxbridge property.

Man Wanted for Allegedly Renting Out Toronto Apartments That Weren't His

Toronto Police are searching for a man who allegedly rented out apartments that were not his, defrauding multiple people in the scam.

storeys.com

storeys.com

Toronto, ON Household Income, Population & Demographics | Point2

Dive into demographic details of Toronto, ON. Learn about Toronto's income, population, and residential life. Toronto currently has 2,794,355 residents, with an average age of 41.5.

Homeownership

Owned households 51.9%

Rented households 48.1%

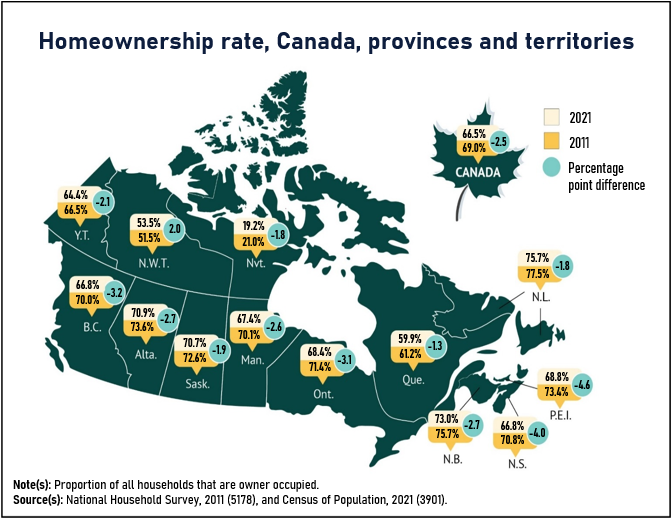

Homeownership rates on the decline in Canada, especially among young adults: data - National | Globalnews.ca

Homeownership rates have declined from the high seen in 2011, Statistic Canada reported on Wednesday, with the situation especially bleak for young millennials.

Home ownership rates on the decline as more people in the GTA, and across Canada turn to renting, new StatsCan census data shows

The number of renters in Toronto soared over the past decade, while for young people especially, the dream of home ownership is dwindling

Sounds like a great place to live.Plenty of Chinese in SouthEast Oakville these days. Those guys pay all cash that is brought in from the Mainland; the husbands go back and forth and work, while the wife stays at home with the child (usually one son). I would say my Mom's neighborhood is about half Chinese now.

Canada has the highest household debt level in G7, housing agency warns - National | Globalnews.ca

Canada's housing agency says the country has the highest level of household debt in the G7, making its economy vulnerable to a global economic crisis.

Canadian mortgage debt surges to $2.08T amid high inflation, interest rates - National | Globalnews.ca

However, the federal housing agency says in a new report that the rate of growth for mortgage debt slowed compared with recent years.

1M mortgage isn't out of the norm nowadays...a 2 car garage in Durham region averages about 1.1 to 1.3M and most people would put down 300k as down....5500 to 6500 mortgage is doable for a household income of 12k a month....most of these houses also rent the basement for 2k up to 2500...sadly that is now the norm. i'm 15yrs away from retirement and may plan is to buy myself a nice cottage up north on the 700k range...nothing too posh...just to launch my boat and fish till a die...

Lol...you obvsiouly don't know what's going on...look at rental ads right now...most are putting ads for rooms at $1200...not apartments, rooms - shared accomodations....some basements have as many as 3 bedrooms, at the low you can rent $800 per room...which is still $2400...plus utilities...this happens more than you think.I remember when 14 years ago when I was renting a basement, my landlord sold his house...2 car garage in brimley & 14th ave....the new landlord were 3 brothers with wives and kids...good landlords too...never bothered me actually gives a bag of rice every month...I left in good terms with them when I bought my own house...This is just BS and not what happens in real life in Canada. I don't know any south Asian Canadians that live like that, it's probably illegal. Works in India, not here.

Btw, Mississauga homes are only 1.3m.

How do you explain Richmond Hill then? There, the average price is $1.8M. Are Italians also stuffing every basement and bungalow bedroom with 3 humans each so they can pay the mortgage on the 1.8M home? What about Markham (1.5M), Asians doing the same thing? Oakville (1.4M), White Canadians also cramping in basements? I don't think so.

Even if we work with those numbers, you're kind of forgetting some of that money is paying the equity of the house plus the original equity is growing over time. Say, the interest payments are $4k/mth, and that $3k/mth that the investor has to cover goes all in equity, then it's still a good investment. Also, the equity growth is roughly 2x-3x in 10 years or less.The rent on these homes is $3400 to $3900 and the mortgage is $6700 without property tax. No investor is buying these homes to rent out in order to lose $3000+ a month.

Dirt cheap housing prices 3 years from now guaranteed if only interest

rate remains this high beyond 2026.

rate remains this high beyond 2026.

Going to chime in here. Could speak to a lot, would take way too much bandwidth. Will say I spent a lot of years in finance. And my “better half” is a realtor. Doesn’t make me right, it means I have knowledge and insights. Few here do…

reading replies, there are some truths, many misconceptions. If any of you experts know the answers. Why are you here, and not on your privately owned yachts in your way to your privately owned tropical islands????????????

bullits.

“Generational wealth”. Seems to me, some of you are kind of expecting that. My advice, is don’t count on it. Your parents are going to need their money, their equity, for their retirements……..In fact, Reverse mortgages ( popular in the EU for years) and becoming more and more and more popular here. “No problem, nothing to worry about I’m going to inherit my parents $$$” Staristics and trends might suggest otherwise.

some are out of touch with respect to “averages” and incomes etc. new flash, the statistical DUO median income ( hope people understand the difference between a median and average) in both Ontario and Canada is $

About 85,000…..lmao at those that think sooooo many bring home 20k/month….

multigenerational homes.

Becoming more popular and builders likewise started to build them. Very common in other cultures, we North Americans struggle with the idea….These will also help parents, conserve their $$ through their retirement years…I wonder how many experts here, know how to calculate how much a person needs for retirement…..

it’s going to crash.

Maybe, if I knew the answer to that I’d be on my private tropical island and not here. Can say, demand>>>>>>>>>>>>>>>>>>>>>>>>>>>>>supply. So long as 70% of all immigrants to Canada heads to the GTA for jobs and a place to live….( used to be 200,000/year and now is 500,000/year…so do the math)….And so long as young Ontarians/Canadians leave the maritimes, Alberta, small town Ontario in search of jobs…

Demand is always going to be here..

rentals.

The amount of $$$ youth are spending for rentals is insane. My “better half” has a hard time securing leases for people without solid credit ratings, cash on hand, and more. And what people get for $2,000/month or more ain’t all that…to add some actual, real context. To secure a lease for one person with decent credit, that person ended up paying $36,000 cash, up front.

There’s a lot more I could but this is long enough. I’ll let the experts continue from their mega yachts.

And if I can give any young people ( I define that as in the 20s, early 30s) a wee bit of advice. Make sure your credit ratings, learn what lenders and landlords look at, it is far far more than a “credit score”…learn how to strengthen your credit resumes. Now…before you strike out on your own, before you want to rent or buy a house with your soulmate that’s anything more than a basement appt of Kijiji..And I will add “side gigs” which often involve a cash economy, do very little with respect to income calculations (when calculating gross debt and net debt) and paying for a lot of things with cash does little/nothing with respect to strengthening a credit rating. Most young people have what is known as a “thin credit profile”.

reading replies, there are some truths, many misconceptions. If any of you experts know the answers. Why are you here, and not on your privately owned yachts in your way to your privately owned tropical islands????????????

bullits.

“Generational wealth”. Seems to me, some of you are kind of expecting that. My advice, is don’t count on it. Your parents are going to need their money, their equity, for their retirements……..In fact, Reverse mortgages ( popular in the EU for years) and becoming more and more and more popular here. “No problem, nothing to worry about I’m going to inherit my parents $$$” Staristics and trends might suggest otherwise.

some are out of touch with respect to “averages” and incomes etc. new flash, the statistical DUO median income ( hope people understand the difference between a median and average) in both Ontario and Canada is $

About 85,000…..lmao at those that think sooooo many bring home 20k/month….

multigenerational homes.

Becoming more popular and builders likewise started to build them. Very common in other cultures, we North Americans struggle with the idea….These will also help parents, conserve their $$ through their retirement years…I wonder how many experts here, know how to calculate how much a person needs for retirement…..

it’s going to crash.

Maybe, if I knew the answer to that I’d be on my private tropical island and not here. Can say, demand>>>>>>>>>>>>>>>>>>>>>>>>>>>>>supply. So long as 70% of all immigrants to Canada heads to the GTA for jobs and a place to live….( used to be 200,000/year and now is 500,000/year…so do the math)….And so long as young Ontarians/Canadians leave the maritimes, Alberta, small town Ontario in search of jobs…

Demand is always going to be here..

rentals.

The amount of $$$ youth are spending for rentals is insane. My “better half” has a hard time securing leases for people without solid credit ratings, cash on hand, and more. And what people get for $2,000/month or more ain’t all that…to add some actual, real context. To secure a lease for one person with decent credit, that person ended up paying $36,000 cash, up front.

There’s a lot more I could but this is long enough. I’ll let the experts continue from their mega yachts.

And if I can give any young people ( I define that as in the 20s, early 30s) a wee bit of advice. Make sure your credit ratings, learn what lenders and landlords look at, it is far far more than a “credit score”…learn how to strengthen your credit resumes. Now…before you strike out on your own, before you want to rent or buy a house with your soulmate that’s anything more than a basement appt of Kijiji..And I will add “side gigs” which often involve a cash economy, do very little with respect to income calculations (when calculating gross debt and net debt) and paying for a lot of things with cash does little/nothing with respect to strengthening a credit rating. Most young people have what is known as a “thin credit profile”.

Last edited: