Good for you (to the OP). Congrats.

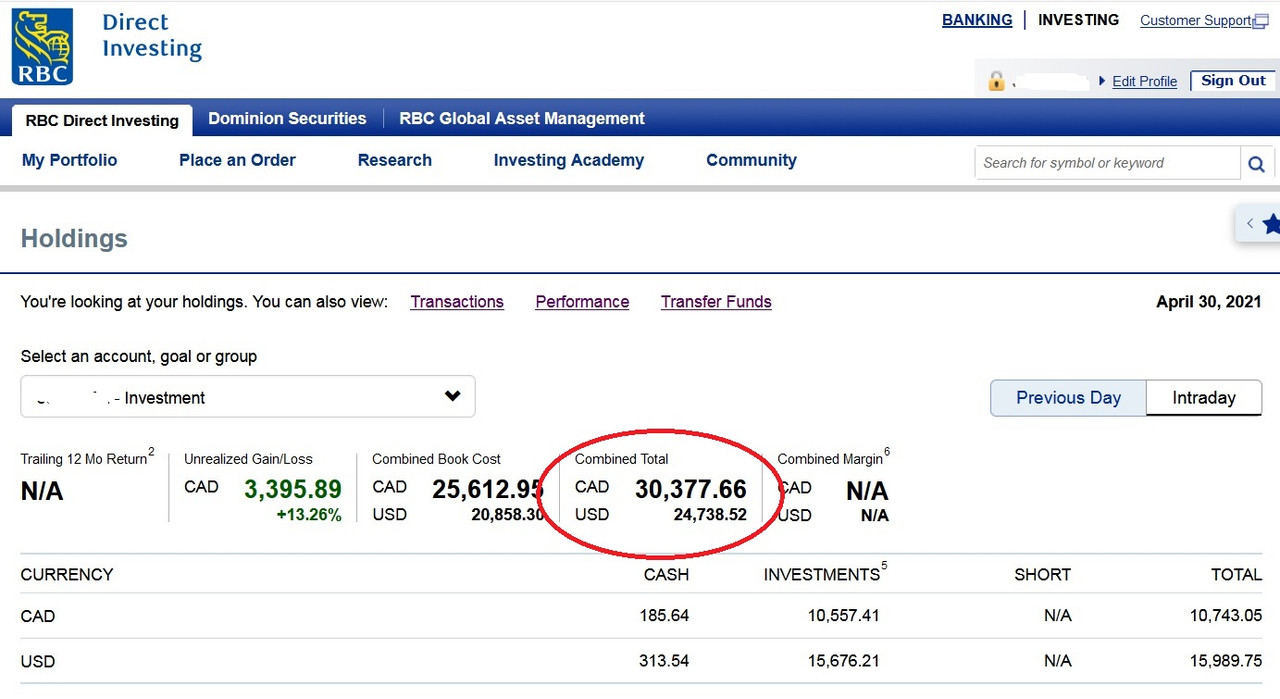

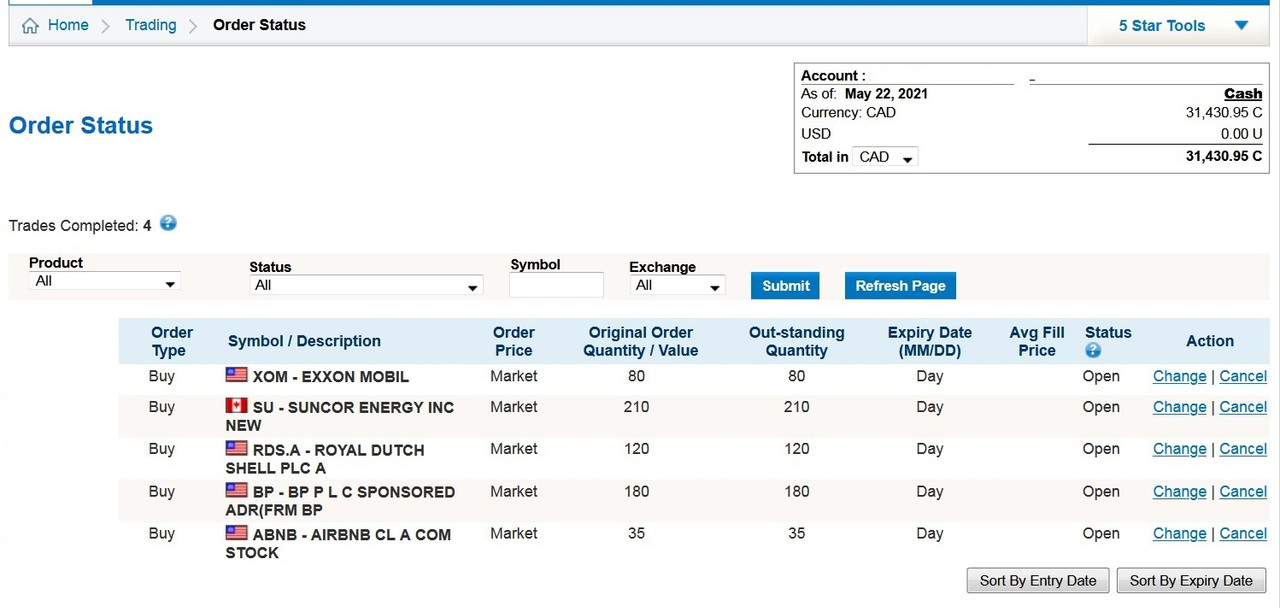

Looking at your holdings, the portfolio lacks diversification. Plus the USD taking a hit vs CAD. Losing on the FX side.

Too many bank stocks. Correlated. My preference (I hold): BMO.

The recovery means a commodity boom and the king of commodities is not oil it's copper.

Got into Canadian copper producers back in December after US elections and the vaccine out. Up over 50% to date.

Large (by Canadian standards...) names LUN, FM, HBM

Small CMMC, CS

and no USD FX exposure.

Looking at your holdings, the portfolio lacks diversification. Plus the USD taking a hit vs CAD. Losing on the FX side.

Too many bank stocks. Correlated. My preference (I hold): BMO.

The recovery means a commodity boom and the king of commodities is not oil it's copper.

Got into Canadian copper producers back in December after US elections and the vaccine out. Up over 50% to date.

Large (by Canadian standards...) names LUN, FM, HBM

Small CMMC, CS

and no USD FX exposure.