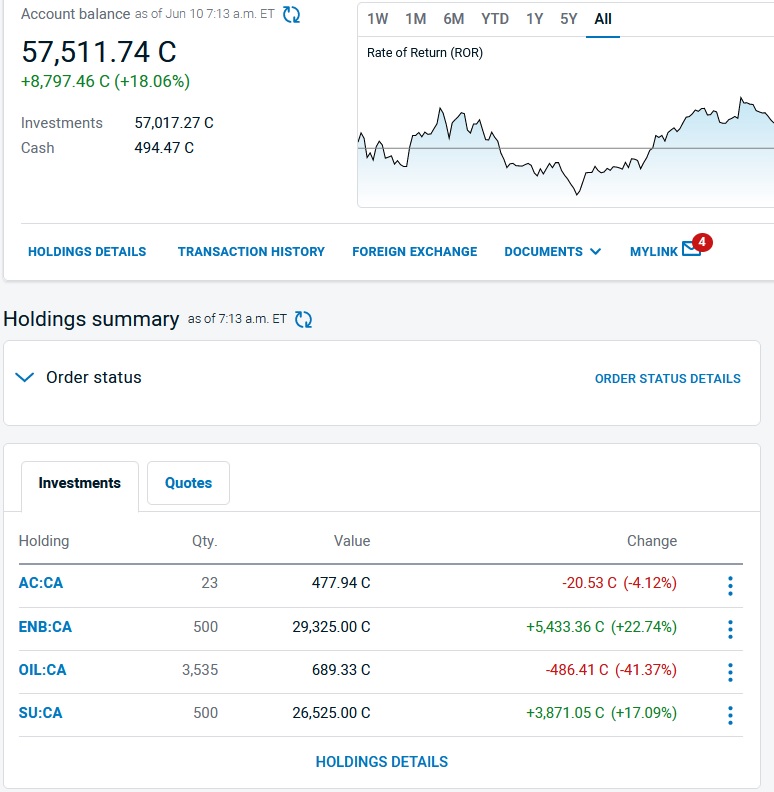

Holy sizzling sheiss, some of my stocks went down. So I bought some more!!!!!!

Patriot Battery Metals Inc. (PMET.CN) @ $3.59

Sigma Lithium Corporation (SGML.V) @ $18.98

Patriot Battery Metals Inc. (PMET.CN) @ $3.59

Sigma Lithium Corporation (SGML.V) @ $18.98