You are missing at least one zero on your investment checks to make such a claim.Thats because I can afford to. Unlike you I dont have to work anymore.

Sucks for you, huh??

Next time I'm at Starbucks I'll be sure to drop a quarter in your tip jar though, I'm nice like that

$18K profit so far

- Thread starter Phil C. McNasty

- Start date

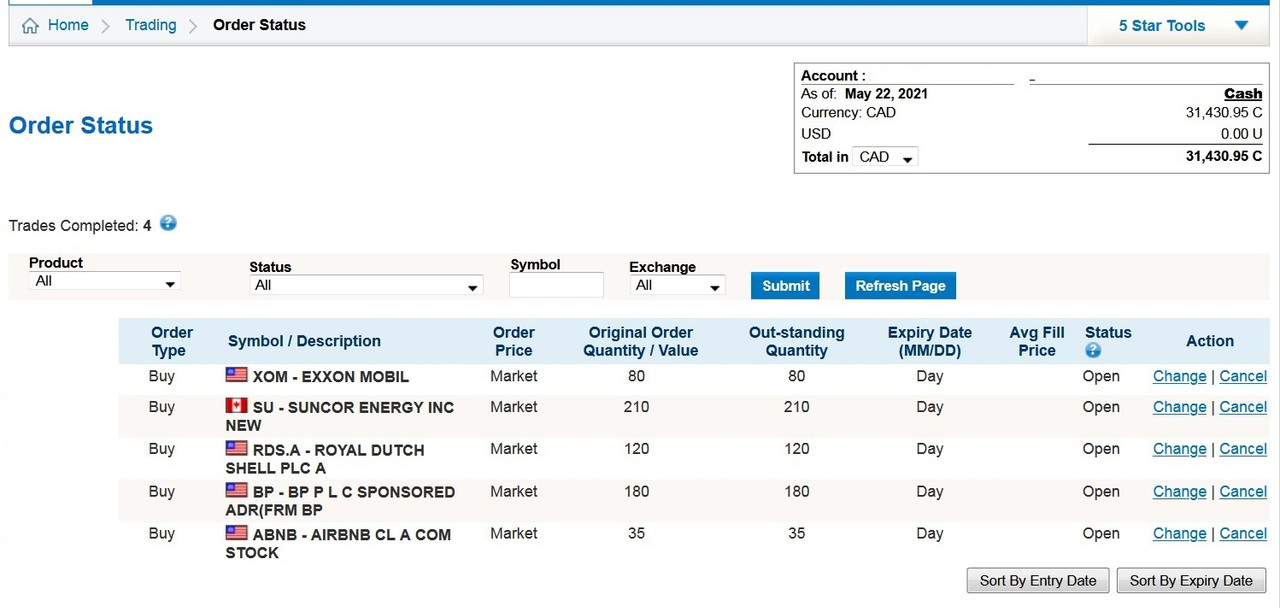

I was always wondering why people are willing to spread $30K over 5 stock paying about 0.2% in commissions (two-ways)? If you want to "play" with your money - chose one stock. If you want to diversify - buy an ETF. IMHO, direct diversification (without ETF) can be beneficial only of you can invest at least $20K in at least 10 stocks each and only if you do not plan to sell them for at least a few yearsToday I bought approximately $30K of:

RDSA 16.39 Euro/share

BP 26.52 USD/share

XOM 58.92 USD/share

SU 27.91 CDN/share

ABNB 134.71 USD/share

That money is just play money. I have a lot more invested in REIT's which is my main source of income, and also IMO the safest investments one can make (especially residential REIT's)You are missing at least one zero on your investment checks to make such a claim.

I'm banking on a quick recovery that will send oil stocks soaring over the next 12 to 18 months. Once everyone's vaccinated people will wanna travel again and make up for lost time. I predict a second Roaring 20's over the next year or twoI was always wondering why people are willing to spread $30K over 5 stock paying about 0.2% in commissions (two-ways)? If you want to "play" with your money - chose one stock. If you want to diversify - buy an ETF. IMHO, direct diversification (without ETF) can be beneficial only of you can invest at least $20K in at least 10 stocks each and only if you do not plan to sell them for at least a few years

I think oil will have at least 1 more bull run before EV's take over.Smart move. World oil supply has nowhere to go but down

in the coming years

EV's still have their problems, about 20 percent of EV owners go back to gasoline cars eventually. The main sticking points are range, charging time and access to electrical outlets in condo buildings. These are bugs that wont be wrinkled out for at least another 5 to 10 years I think. Until then oil will still reign. At least thats what I'm banking on

New study explains why nearly 20 percent of electric car owners return to gas

Some EV owners are not satisfied.

So, your real investment strategy you used at REIT is different from what you are showing here. Care to share your "true" investments strategy with "real" money? Or should we call it a bullshit?That money is just play money. I have a lot more invested in REIT's which is my main source of income, and also IMO the safest investments one can make (especially residential REIT's)

Still, with so little money invested, why not to go with low-cost energy ETF like HXE.TO? How much are your trading costs per order?I'm banking on a quick recovery that will send oil stocks soaring over the next 12 to 18 months. Once everyone's vaccinated people will wanna travel again and make up for lost time. I predict a second Roaring 20's over the next year or two

Hey, you catch on quickSo, your real investment strategy you used at REIT is different from what you are showing here

I just told you. They are mostly REIT's mixed with CDN bank stocks.Care to share your "true" investments strategy with "real" money? Or should we call it a bullshit?

Those to me offer the safest investments at the highest returns.

And who gives a rats ass if you think thats bullshit or not

Because I chose to plop some money into oil stocks and AirBnb which I think will do well short-term.Still, with so little money invested, why not to go with low-cost energy ETF like HXE.TO? How much are your trading costs per order?

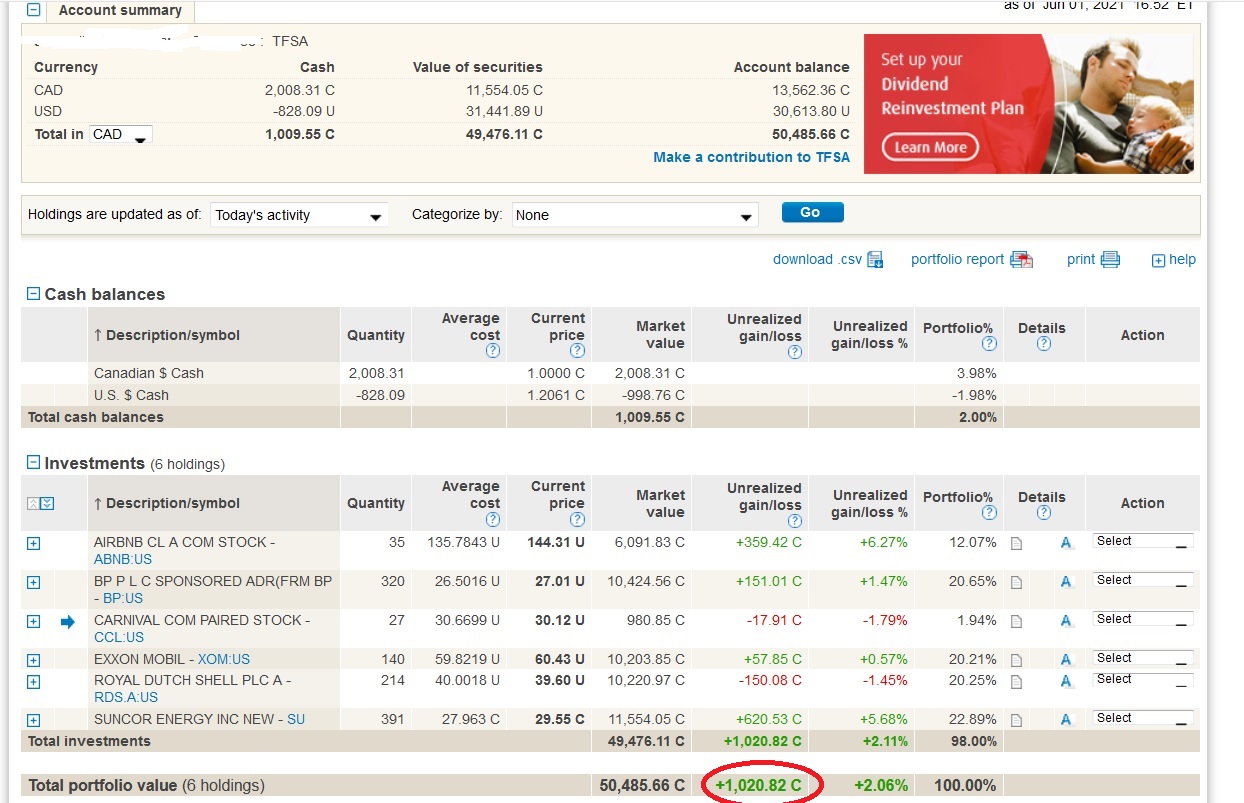

Today I'm up over $1K already, Can you argue with success??

And yes I know tomorrow it can sink again, but like I told you they should do well short-term as we recover from the pandemic.

I also added $1K of CCL today

Hmm anyone into just penny stocks? It isn't scary as what most people think, but if you're thinking of tossing money into a stock thinking it's going to gain half the time of course you're gonna lose. Tis not a gamble nor should it be. What's people's opinions on penny stocks?

My portfolio is just 7 stocks. Holding long, all companies I have interest in, waiting to get paid. And because of research, I'm on a trail wind of stocks, which I take heed before entering. Position is always important, strategy, RSI, entry point.. I take all those things in consideration. Charts, mac-d, market cap, volume, manipulation... Do people understand this stuff? Or am I playing in the deep end of the game. If all goes well should be swimming in it soon so wish me luck

Also relatively new, but managed to triple my initial investment, divergence brought it down, still didn't go in red... Finally market is making a turn now, already reorganized my portfolio.. and still just my profits fluctuating.. continue holding. The gains are too huge.. compared to blue chip.. though I have an idea what I want when I become the long term dividend investor.. building capital atm. GLTA.

My portfolio is just 7 stocks. Holding long, all companies I have interest in, waiting to get paid. And because of research, I'm on a trail wind of stocks, which I take heed before entering. Position is always important, strategy, RSI, entry point.. I take all those things in consideration. Charts, mac-d, market cap, volume, manipulation... Do people understand this stuff? Or am I playing in the deep end of the game. If all goes well should be swimming in it soon so wish me luck

Also relatively new, but managed to triple my initial investment, divergence brought it down, still didn't go in red... Finally market is making a turn now, already reorganized my portfolio.. and still just my profits fluctuating.. continue holding. The gains are too huge.. compared to blue chip.. though I have an idea what I want when I become the long term dividend investor.. building capital atm. GLTA.

Last edited:

Suncor is one of my favourites.For long term hold I'd prefer Suncor and CNQ to some energy ETF

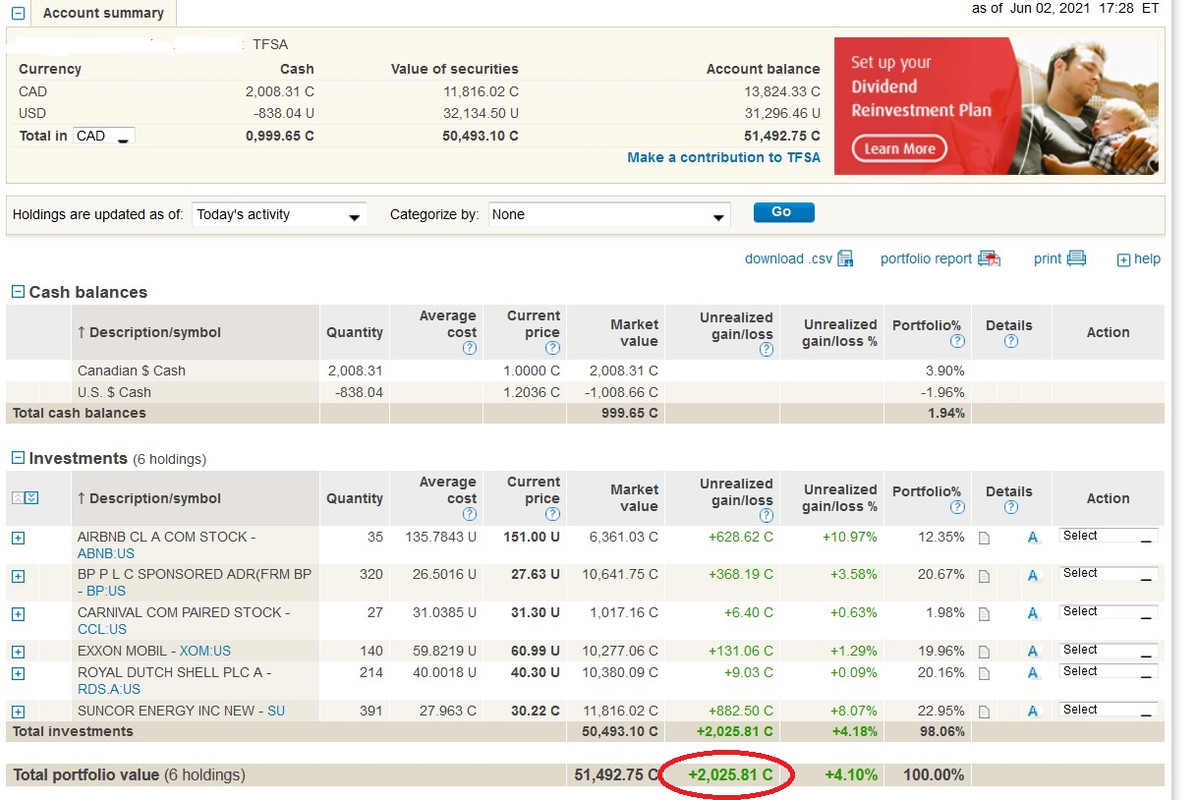

Today I'm up over $2K

I'm playing with penny stocks, too. Though, not as my major investments.Hmm anyone into just penny stocks? It isn't scary as what most people think, but if you're thinking of tossing money into a stock thinking it's going to gain half the time of course you're gonna lose. Tis not a gamble nor should it be. What's people's opinions on penny stocks?

My portfolio is just 7 stocks. Holding long, all companies I have interest in, waiting to get paid. And because of research, I'm on a trail wind of stocks, which I take heed before entering. Position is always important, strategy, RSI, entry point.. I take all those things in consideration. Charts, mac-d, market cap, volume, manipulation... Do people understand this stuff? Or am I playing in the deep end of the game. If all goes well should be swimming in it soon so wish me luck

Also relatively new, but managed to triple my initial investment, divergence brought it down, still didn't go in red... Finally market is making a turn now, already reorganized my portfolio.. and still just my profits fluctuating.. continue holding. The gains are too huge.. compared to blue chip.. though I have an idea what I want when I become the long term dividend investor.. building capital atm. GLTA.

Check my posts earlier in the thread.

Care to share which stocks you're in?

So, you are basically saying that what you post is not "investment strategy" but your "game of skills" strategy, like friendly poker game poker. Fair enough, but, I think, a disclaimer saying it would be nice, otherwise some naive people can think of it as the way to invest.Hey, you catch on quick

I just told you. They are mostly REIT's mixed with CDN bank stocks.

Those to me offer the safest investments at the highest returns.

And who gives a rats ass if you think thats bullshit or not

Did you even read this whole thread. Go back to page 1.So, you are basically saying that what you post is not "investment strategy" but your "game of skills" strategy, like friendly poker game poker. Fair enough, but, I think, a disclaimer saying it would be nice, otherwise some naive people can think of it as the way to invest

How can an approximate 50% return over the last 13 months be a bad investment??

Better yet, lets see your portfolio.

Why dont you suggest some stocks for us right now, and lets see how they do over the next 12 to 18 months

I second the motion that U-man is full of bullshit, this financial exhibitionist has shown you his "play money" financial statements but will not show you the bulk of his vast fortune?Care to share your "true" investments strategy with "real" money? Or should we call it a bullshit?

Phil C. once PMed me and told me that he owned high rise apartment buildings, more likely he is the janitor at these high rise buildings that have monthly drive by shooting out front.That money is just play money. I have a lot more invested in REIT's which is my main source of income, and also IMO the safest investments one can make (especially residential REIT's)

I haver already asked him to tell of his investment methods and strategies and he has gone silent on this matter. He probably does not own or even know what a REIT is.

Last edited:

It is bad investment because you, yourself, invest only a small portion of you money this way and prefer to keep you main investment in a well-diversified portfolio. If you believe that it is a good investment, why you only use your "play money" and not real money this way? The fact that you had realised 50% return is not an indicator that it was a good investment - it simply a result of the general market trend and luck.Did you even read this whole thread. Go back to page 1.

How can an approximate 50% return over the last 13 months be a bad investment??

Better yet, lets see your portfolio.

Why dont you suggest some stocks for us right now, and lets see how they do over the next 12 to 18 months

As for myself, I only have $300,000 to invest, which is too little to try to diversify myself, so, I simply buy VCN.TO. Best long-run investment in Canada: it is easy to top it up and management fee is only 0.05% a year ($150 in my case). But I am at the point where I may buy top 20 VCN.TO holing myself and hold it for 10-20 years so that I will save a bit on management fee even if I give up a bit of diversification. Buying stocks for 1-3 years in small denomination (under $20K) without proper diversification is not investment - it is speculation (or, in your case, gambling)

Last edited: