Let’s discuss Canada’s national debt from the perspective of a total outsider from the US.

Carney's proposed spending, which will increase debt, is somewhat similar to Biden's actions. Investing in the future yields positive economic results. i.e., the infrastructure bill and tax incentives for clean energy, new manufacturing plants, suspending student loan debt, and many other bills he got passed to help the middle class and an investment in the future of the US. Many plants were open, like in Ohio, with the opening ceremonies or ribbon-cutting, the Republicans who had voted against the bill were now praising it as if they had been for it, when they had not.

The Biden tax credits enabled the purchase of massive TSMC fab plants for the most advanced chips, bringing them to Phoenix and other new fabs across the US, thereby investing in a high-tech future and creating numerous high-paying jobs. Spanning over 1,100 acres, the site is planned to eventually house up to six fabs. As of now, three fabrication plants have been launched, accompanied by two advanced packaging facilities and one R&D center, collectively forming a full-scale semiconductor manufacturing ecosystem. These are examples of good debt, as revenues decreased due to the tax credits. Just like much of Carney's proposals..

The Harris platform prioritized increased spending to improve lives, including child care and other essential services, thereby freeing up parents to be in the workforce. We have near-record-low unemployment and an economy that most of the world envies —until Trump.

Now up there... in Canada. You have a very low debt-to-GDP ratio compared to the rest of the G7, and there is room for "growth debt."

When the Canadian government takes on debt, it is mainly owed to yourselves. Most of Canada’s federal debt is held domestically—through Government bonds purchased by pension funds, banks, including the Bank of Canada, and even individual Canadians. Your debt is widely circulating within your economy, affecting Canadians.

Much of what Cary is proposing is to invest in long-term value such as healthcare, Transit & infrastructure, Skills training, Affordable housing • Clean energy, Child care etc..

The things that build a country and foster economic growth. It's like a business borrowing to buy real estate for expansion, or to purchase robots for greater efficiency, or other machinery or equipment. This is called investment and is seldom paid for out of current operating expenses; instead, it is typically funded by issuing bonds, equity, or through bank financing or lines of credit.

Think of it like a business borrowing to upgrade its equipment. It’s not waste—it’s an investment.

If Canada invests $1 billion, it should amortize that investment, just like a business would, considering depreciation on real estate, even if the value increases under US Generally Accepted Accounting Principles (GAAP). Perhaps consider it a cost over, such as a 20-year benefit period. Some of the benefits are intangible, making families feel more secure, while others are tangible, including higher wages and income taxes paid to Canada, as well as various other taxes.

Currently, Canada’s debt-to-GDP ratio stands at approximately 50%. You also have an AAA credit rating by Moody's, among others, which is better than the US. Your debt-to-GDP ratio is relatively low compared to your G7 peers: U.S.: ~112%, Japan: ~205%, France: ~93%, Italy: ~132%, UK: ~100%. and Germany: ~45%

Canada has an AAA credit rating from Moody’s, which is a few steps stronger than the US. Global markets trust Canada to pay its bills, and that translates to lower borrowing costs and long-term financial stability.

Was COVID borrowing reckless? No. It was an emergency response aimed at preventing economic collapse and averting numerous business and family bankruptcies.

Back in the late 90s, your ratio was close to 70%, but you brought it way down with the US/Musk Chainsaw massacre of most agencies and programs, which is the opposite of investment in the future.

Interest payments are relatively low, especially since most of your long-term debt is locked in at much lower rates. New debt will be more expensive, but it will still be a relatively small part of your annual budget, far less than in the US.

That’s what smart debt looks like. It’s not just about the money—it’s about what we’re building with it.

Often, the best investments don’t just appear on a balance sheet. But in

Classrooms, Hospitals, Roads and broadband, Stronger families, and Smarter workers

Just the facts, not ravings like from Trump, why Canada should be the 51st State:

"We don't need them to make our cars, we make a lot of them, we don't need their lumber because we have our own forests... we don't need their oil and gas, we have more than anybody."

Trump reiterated the assertion that the US has a trade deficit with Canada of between $200 billion and $250 billion. It's unclear where he obtained that figure. The trade deficit with Canada, expected to be $45 billion in 2024, is primarily driven by US energy demands.

Just the facts, not rants and misinformation on social media vs real journalists (most of whom left the Fox News division, not able to stand the misinformation of Fox and related propaganda talking points vs facts and science.

Carney platform promises $130B in new spending, deficits until 2029 :Heart Attack:

- Thread starter DesRicardo

- Start date

I told you that your peak was in November when Trump won.Well good for the liberals... Trudeau and jaghmeet Era is over... I can live with Carney.. lets see if he can work with Trump.

Downhill from then on.

No he is not going to work with Trump.

He is no quisling.

He is going to stand against Trumpism and you are going to have to continue living vicariously.

peak on Nov? LoL.. Trudeau and Jagmeet is gone...if Carney wants to maintain the liberals for the next 10 years...he better turn this ship around...Ontario turned blue on the liberals... woke s done... Carney will move the liberals close to the center... I'm not gonna throw a fit over this election...what is gonna change? nothing. Trump and Carney will work t hings out...watch.I told you that your peak was in November when Trump won.

Downhill from then on.

No he is not going to work with Trump.

He is no quisling.

He is going to stand against Trumpism and you are going to have to continue living vicariously.

Yeah nice try with that mental gymnastics.peak on Nov? LoL.. Trudeau and Jagmeet is gone...if Carney wants to maintain the liberals for the next 10 years...he better turn this ship around...Ontario turned blue on the liberals... woke s done... Carney will move the liberals close to the center... I'm not gonna throw a fit over this election...what is gonna change? nothing. Trump and Carney will work t hings out...watch.

Your dear leader lost his seat.

Deal with that while you deal with full on DEI and transwomen in women's bathrooms or what have you. lmfao.

It was all opinion and not supported by facts. You mix bits of truth and lies and blend in your bias and you try and push it as fact.What I said wasn't an opinion.

It was fact.

Facts can be fact checked.

he is done, he got his pension... NDP got battered...the writing is on the wall... Trudeau was the bottom... Carney is an improvement.Jagmeet Singh has gone through three different elections as the leader.

Time for change for the NDP!!

that's the best you can do? lol... trans women in women's bathroom? i thought "trans women" are women? why you still using that prefix?Yeah nice try with that mental gymnastics.

Your dear leader lost his seat.

Deal with that while you deal with full on DEI and transwomen in women's bathrooms or what have you. lmfao.

No silly...are you trying to miss the point on purpose here?Greenhouse Gas Emissions are always bound to be higher, when the population is denser.

Has nothing to do with the GDP, as you as usual are comparing apples with crumbs.

It is like you comparing the number of Golf Strokes vs the Basketball Points. You will think that you won at Golf as you had more more strokes than your competitor........ROTFLMAO!!

As usual you cannot comprehend this very simple fact!!

"per capita" you use it when those stats jive with your narrative, and then ignore it when those stats don't.

Is that too difficult for you to understand?

That's enough to bury your hopes and dreams of a MAGA utopia!that's the best you can do? lol...

Get used to these losses. lmfao.

It’s only good if the money spend is earned through a transaction of goods and services, but if your print money to spend. It devalues your currency and causes inflation.You gotta spend money to make money. And if that doesn't work, just spend more. I guess you guys never took Economics?

who lost? not me...LoL..Carney will work with Trump...Trump kinda likes Carney... you're the one who can't accept Kamala lost..That's enough to bury your hopes and dreams of a MAGA utopia!

Get used to these losses. lmfao.

None of what I said below in these sentences is opinion.It was all opinion and not supported by facts. You mix bits of truth and lies and blend in your bias and you try and push it as fact.

They are all fact.

Denying due process - is a violation of the constitution.

Deporting people when the courts order you to stop, is violating court orders.

Appointing unqualified people like Hegseth, Kash Patel, RFK Jr etc in positions of power, due to their loyalty, is appointing yes men.

Bringing Musk who is unelected to gut federal agencies that provide oversight, is as I said.

Everything I have said is 100% the truth.

Violating the constitution, defying court orders, appointing yes men, bringing unelected billionaires to gut federal agencies to destroy oversight, deliberately using power to wage culture war, are authoritarian fascist actions that only Trump is doing.

Carney does not have to be elected.

That is per Canadian law. A PM does not have to be directly elected by the people, nor does he/she have to be an MP.

Nothing Carney did was a violation of the Canadian constitution and he also called for an election immediately.

Yes, you and your MAGA ideology took a shellacking last night.who lost? not me...LoL..Carney will work with Trump...Trump kinda likes Carney... you're the one who can't accept Kamala lost..

FAFO.

And no, Carney isn't going to work with Trump. Work with in your lingo being kow towing and becoming a quisling.

He is going to work with Europe and the rest of the world, and respond to Trump and his threats.

Carney won and you still can't move on from Donnie?None of what I said below in these sentences is opinion.

They are all fact.

Denying due process - is a violation of the constitution.

Deporting people when the courts order you to stop, is violating court orders.

Appointing unqualified people like Hegseth, Kash Patel, RFK Jr etc in positions of power, due to their loyalty, is appointing yes men.

Bringing Musk who is unelected to gut federal agencies that provide oversight, is as I said.

Everything I have said is 100% the truth.

Peepee is MAGA? LoL... I like Carney, even the Liberals have a Minority...but unlike Trudeau, IMO Carney looks like he can work with the conservatives and Trump...Yes, you and your MAGA ideology took a shellacking last night.

FAFO.

And no, Carney isn't going to work with Trump. Work with in your lingo being kow towing and becoming a quisling.

He is going to work with Europe and the rest of the world, and respond to Trump and his threats.

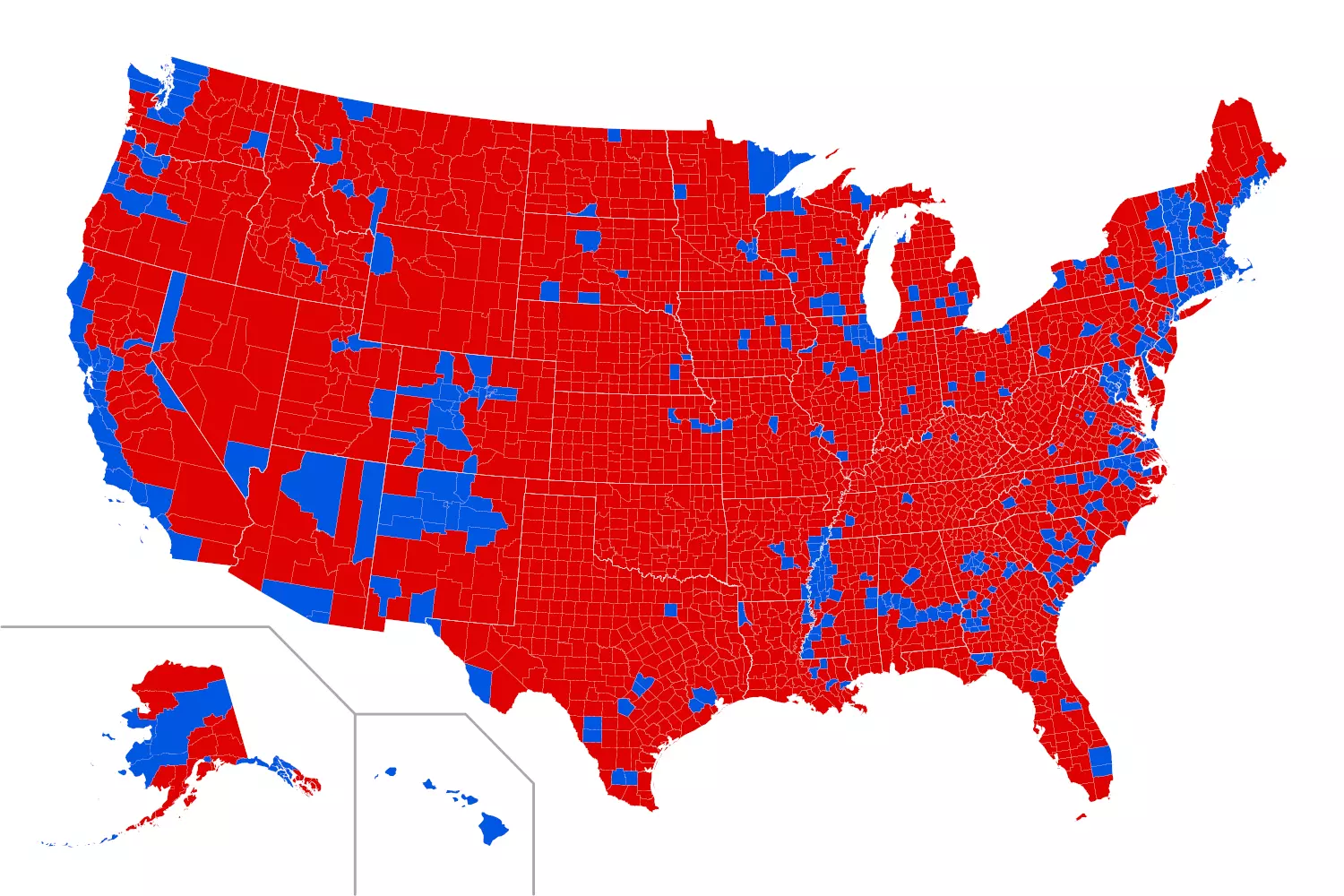

This is what shellacking looks like...

I don't care about the US where you and I don't live.Peepee is MAGA? LoL... I like Carney, even the Liberals have a Minority...but unlike Trudeau, IMO Carney looks like he can work with the conservatives and Trump...

This is what shellacking looks like...

I rejoice that whatever you call shellacking or preferred cultural values is merely a vicarious experience for you and will stay that way.

Of course you "like Carney" now. lmao.

Is Carney Trudeau? no he isn't? the change I want is done...Jagmeet is done... the only reason liberals won is that Trudeau quit...Carney is an upside...i can rejoice with you too...LoL...I don't care about the US where you and I don't live.

I rejoice that whatever you call shellacking or preferred cultural values is merely a vicarious experience for you and will stay that way.

Of course you "like Carney" now. lmao.

Tactical softening of your stance I see. lmao.Is Carney Trudeau? no he isn't? the change I want is done...Jagmeet is done... the only reason liberals won is that Trudeau quit...Carney is an upside...i can rejoice with you too...LoL...

I'm open to anything lol...I lived on Harper and 9 years of liberal...what's another 9 years of liberal if that's what majority wants? I voted Trudeau on legal weed...but his scandals and woke-ism i can't stand... Carney winning is better than Trudeau still in power...Tactical softening of your stance I see. lmao.