Okay, this is my updated prediction, and what I'm going to do:

1)Bitcoin will continue to slowly rise before halving, maybe even make some big moves, inching towards 100k.

2)The halving will be in April, and Bitcoin will steadily increase its pace of gains

3)The Fed will cut rates on May 3, increasing the supply of cheap money, this will accelerate demand the send the price soaring, as well as the limited supply and ETF purchases. There is a possibilty of a "buy the rumour, sell the news" on this date,

and Bitcoin could crash when the Fed announces its decision to cut rates.

4)The media will begin to hype up the fact Bitcoin keeps reaching new Milestones. Demand for ETFs soar just like lottery tickets during powerball. Bitcoin will start rocketing towards 200k.

5)On its way to 100-200K, probably closer to the 100k mark, there will be a sharp correction caused either by manipulation to spook investors or investors taking profit, and drive down the price, maybe 20-30%.

It's impossible to say how it would go, but we can probably see a peak of 130k-250k.

6)Sometime mid/late this year the price will begin to stabilize as those exiting will reach balance with those buying.

7The price will begin to fall drastically, to below 100k.

What happens thereafter is anyone's guess, there are just too many variables. One likely scenario is that it will be a repeat of the last cycle, with a drop after the first peak, and then a second top before another crash. It is also possible that the whole thing just fizzles out.

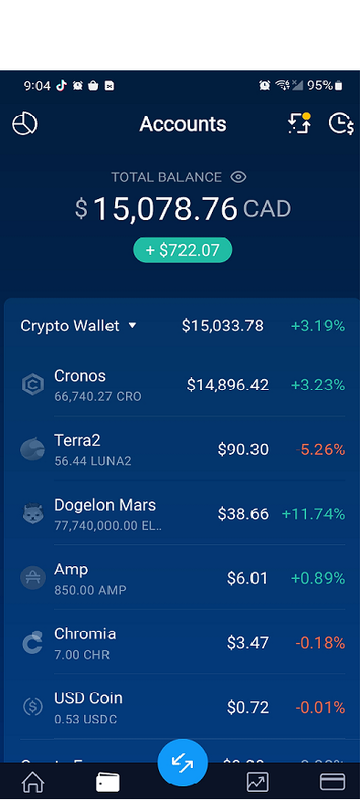

My strategy is a quick, get in, get out strategy.

1)Hold until Bitcoin reaches 130-200K or more

2)When the large correction comes somewhere between 100k to 200k, I will hold and brave it out. The biggest mistake and pitfall is to panic and sell. Remember, we are very early in the bull run (supposedly), so there will immense demand for Bitcoin

even after the correction, as many retail investors will be snatching up the "discounts"

3)When Bitcoin goes over 130-200k, I will dollar cost average out every day as soon as Bitcoin starts the gains start to decelerate and plateau. If I see a sharp decline, I will exit immediately. In fact, as soon as the price stabilizes and starts to decline, I think I will cash out immediately, everything. Why risk the unknown for a few thousand more dollars?

Key points: dont' be greedy, aim to 2x to 3x your money if you just bought in at 60K level. Don't panic during correctons, hold and DON'T sell. Sell over a few days as soon as Bitcoin reaches 150-200k, stabilizes, and then gradually the momentum turns, and the prices keep falling. Lock in your profits, and don't be greedy and try to wait for higher prices. They may come, but you risk losing everything, and might have to wait another four years.

Also, since I do not own my Bitcoin directly, but through an ETF, which cannot be traded on weekens and holidays I will sell immediately on a Friday if I have reached the 150-200k level, and we are in the stabilising phase, with prices flat or falling. I don't want to be helpless during the weekend while Bitcoin crashes 30-50%. The May 3 date on Friday, the day the Fed announces rate cuts is crucial. Bitcoin could crash over the weekend, even if they announce rate cuts.