Silent.

whether fudging or overstating to gain more support should a referendum happen, or simply as the starting point ahead of negotiations should a referendum be a go. No one knows. Even the people that would have better ideas, than anyone here are all over the map. That alone should be giving people……

It would take actuaries “forever” to drill down through stuff. Let’s for arguments sake just agree Tmbre is close. 20-25%. If your the government and CPP and your priority is protecting pensioners as much as possible. Would you risk the Supreme Court siding with you at “25-27%” or very possibly deciding “33-38%”?

Re scales of economy.

BY FAR, not a little BY FAR the best run pension plan is OTPP (Ontario Teachers). Net assets as at fiscal year end 2022

just 240 billion…

And who manages their pension plan…..

So to think an APP can’t outperform CPP by a country mile is just wrong and illustrates just how little people know.. ( not saying you do)

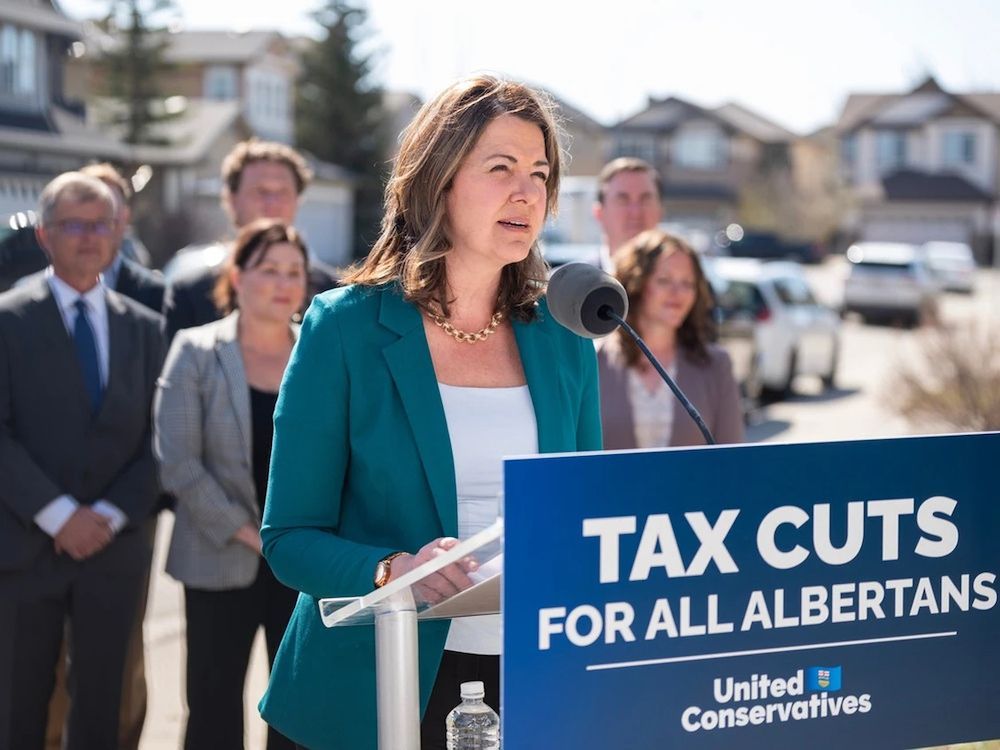

I think the issue here is the UCP is playing fast a loose with facts and figures. They've launched a website that asks VERY leading questions about an APP, except for the question if they should leave the CPP.

As for if a APP could outperform the CPP...I don't know. I mean, there is more to running a pension fund than buying stocks and bonds or investing in infrastructure projects. As mentioned, the fees are a major thing, and the bigger you are, the smaller your fees. Now, OTPP is a very well managed fund, no questions, as is OMERS, CDPQ, HOOPP and so on and so forth. The CPPIB over the last 10 years has done exceptionally well.

Now, could the APP make bigger and better bets and see greater fund growth? Sure, but they would have higher fees. And then there is the whole concern over political interference. Right now, no pension fund in Canada is mandated to invest in any sector or area of the country (as far as I know). But, would the APP be like this? Or would they be forced to allocate a certain amount of funds to Alberta's energy sector? Or the premier's pet projects? That's where the biggest issue could be.

But, we'll see what happens. I think a referendum is a fait accompli, and the question will likely be misleading. Will the majority of Albertans approve of it? Hard to say.