$18K profit so far

- Thread starter Phil C. McNasty

- Start date

Sold all 350,000 shares of HIRU for $2,100 profitBought 350,000 shares of HIRU @ 0.0088 USD per share

I love that you share your gains and loses with the collective. This is commendable and we don’t see often on hereSold all 350,000 shares of HIRU for $2,100 profit

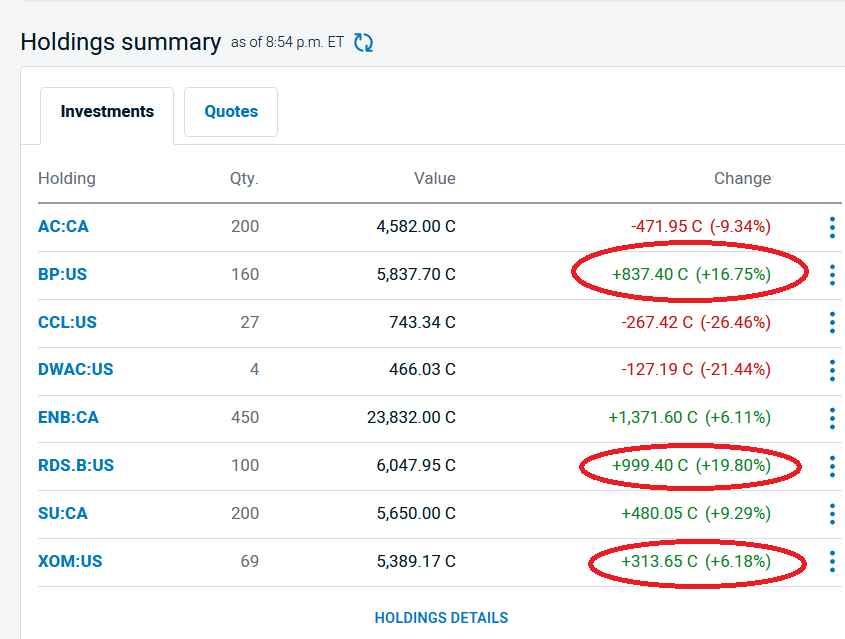

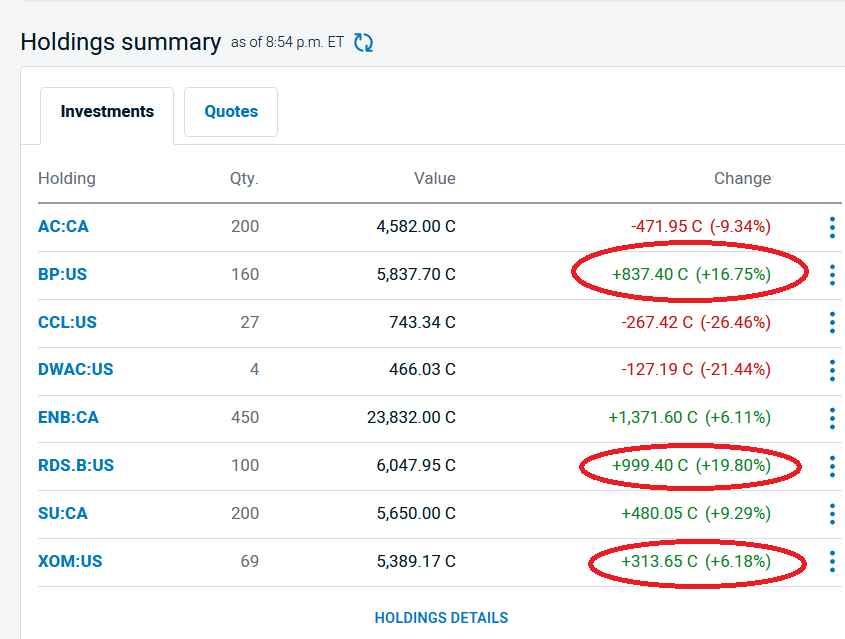

Sold just over $2,000 of 3 oil stocks for profit. Might buy again in a few weeks, but I'm worried about a minor dip

Man this keeps up might be his most successful entry ever...maybe even best terb entry/gains of the year lol Wonder how far it will keep climbing.shib!

shib!

...and they say crypto is a scam or speculation

Here is another guy saying he would have had $1billion if he held $2000 since January of last year. The guy can barely breathe lmfao

No wonder Phil has been quite recently...probably enjoying his yacht in the Caribbean ATM

Yo bro don’t forget us little guys when you become a billionaire.

Last edited:

Pretty much, yup.

Whenever I invested long-term in mostly blue chips I always made good money.

And whenever I started speculating on penny stocks or other volatile stocks I mostly lost.

So I stopped doing the latter and just stick with blue chips now.

P.S. I think oil has 1 or 2 more good runs in its tank before the world switches to EV's

Ummm, oil is in a significant backwardian position because of just this type of magical thinking. The woke need to wake up.Pretty much, yup.

Whenever I invested long-term in mostly blue chips I always made good money.

And whenever I started speculating on penny stocks or other volatile stocks I mostly lost.

So I stopped doing the latter and just stick with blue chips now.

P.S. I think oil has 1 or 2 more good runs in its tank before the world switches to EV's

Suncor just killed it with their quarterly.

And doubling their dividend.

Happy I bought last year at $19

And doubling their dividend.

Happy I bought last year at $19

Quite happy with its movement . I got into at 25.20. GLSuncor just killed it with their quarterly.

And doubling their dividend.

Happy I bought last year at $19

The best move for me was sitting pat through the start of COVID, and not executing on trades until June 2020.

Took the cash that had accrued from divvys and reinforced positions in bank stocks that had weakened and loaded up on REITs, who had had the shit kicked out of them.

I have not tallied those moves in detail, other than to say REITS have recovered quite nicely, and the banks are all sitting pretty and have just been allowed to start raising their divvy pay outs, so that bodes well for both amount of dividends and the stock price to generally appreciate.

The second best move was to buy into an actively managed preferred share ETF.

Preffereds I believe are worth the management as the pool in Canada is kinda small and there are likely arbitrage and other situation Joe Q public are not savvy to.

Put 210K in 2018. Spits about $900 per month payment, mix of dividends and return of capital.

The slide in rates since when we got in on this means folks are clamoring for yield wherever it can be found. The holding is now worth 280K, even with the payouts not part of that sum, as not reinvested.

Rates will change, and likely the thing will be back at $210K in the coming decade, erasing and capital gains once the payout ACB is factored in.

In the mean time we will stay with it while payout keeps up. Rate resets in the preferred shares it holds are likely to make it into a bit f a slower horse over time.

Took the cash that had accrued from divvys and reinforced positions in bank stocks that had weakened and loaded up on REITs, who had had the shit kicked out of them.

I have not tallied those moves in detail, other than to say REITS have recovered quite nicely, and the banks are all sitting pretty and have just been allowed to start raising their divvy pay outs, so that bodes well for both amount of dividends and the stock price to generally appreciate.

The second best move was to buy into an actively managed preferred share ETF.

Preffereds I believe are worth the management as the pool in Canada is kinda small and there are likely arbitrage and other situation Joe Q public are not savvy to.

Put 210K in 2018. Spits about $900 per month payment, mix of dividends and return of capital.

The slide in rates since when we got in on this means folks are clamoring for yield wherever it can be found. The holding is now worth 280K, even with the payouts not part of that sum, as not reinvested.

Rates will change, and likely the thing will be back at $210K in the coming decade, erasing and capital gains once the payout ACB is factored in.

In the mean time we will stay with it while payout keeps up. Rate resets in the preferred shares it holds are likely to make it into a bit f a slower horse over time.

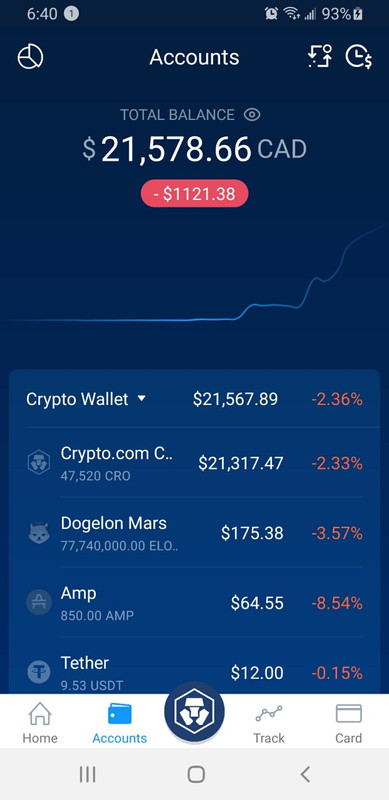

lol getting addicted to those crypto gains !!!I bought $16K worth of CRO last week. Its already up $5,500.

I've changed my mind on crypto, it looks like its here to stay.

CRO is nice and low right now at $0.36. I predict it will go up to a few dollars in a couple of years from now

crypto !