At the most basic level (not really correct but for illustration)...Well you are referring to 80 to 100K which is precisely his example of 100K.

In any event I can't see how dividend tax credits can offset that much income.

I have plenty of Dividend paying investments and my dividend tax credit is nowhere close to offsetting much income.

I'll certainly check out taxtips.ca

In Ontario the dividend tax credit is 25%. That is, 15% federal and 10% so total of 25%. So, say you make $60,000 dividends (about $1.5M investments). That's grossed up $60,000 x 1.38 to $82,800. You get a dividend tax credit of $82800 x 25% of $20,700.

At $82,800, your combined tax rate $49,231x 20.05%+ $4128 x 24.15%+ $29441x 29.65% for a total of $19,596.98 in income taxes. At this amount the tax you pay with the DTC is a wash. Add in Basic Personal Amounts as well as a few other smattering of credits and you can see how you can add RRSP/RIF income and still pay <5% tax.

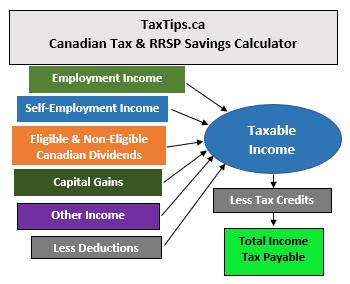

Using the detailed taxtips calculator

TaxTips.ca - 2024 and 2025 Canadian Tax Calculator

TaxTips.ca - 2024 and 2025 Canadian income tax and RRSP savings calculator - excellent tax planning tool - calculates taxes, shows RRSP savings, includes most deductions and tax credits.

With $60,000 (actual) of eligible dividend income, the tax rate would be 3.22% for 2023. Add in another $15,000 of RRSP/RIF income, for a total income of $75,000, and your tax rate would be 5.4%.

Another example is $15,000 of capital gains (for a total income of $75,000) and your tax rate would be 5.32%.

You can see how you can play - for future planning purposes - with the mix of taxable, non-taxable (TFSA) and tax-deferred (RRSP) investments to determine your best/optimum retirement income. Add in other tax credits, carry over capital losses, as well as, say, pension splitting when this happens & if applicable, and you can see how you get to that lower tax rate.

Investing is not always about about how you put it in but sometimes more importantly how you withdrawal (yes, that was a joke, this is TERB).

Dividend income from Blue Chips should grow about 7.5% +/- a year so it can work quite well for a number of years**.

**note that dividends are quite tax-costly once you get beyond $150K-ish in income and capital gains become MUCH MUCH better tax-wise. But hey, $150K of retirement income is a good thing to have and not many people have to worry about that particular problem.

Next up; how to hide cash flow from the spouse to spend on SPs using RESPs.

Last edited: