Apple shares drop on report of weak demand

Apple has reduced its iPhone 5 component orders on weaker-than-forecast demand, according to a report in The Wall Street Journal on Monday.

In pre-market trading, Apple stock was off almost $20 to $500.74 a share. Apple is to release its latest quarterly earnings report later this month.

The WSJ report, which cited unnamed people familiar with the matter, said orders for iPhone 5 screens for the January-March quarter are about half of what the company was expecting. Orders for other types of components have also been reduced, the WSJ article said.

The report said one of the people told the newspaper that Apple has also cut orders for other components. The Journal said it was told Apple notified the suppliers of the order cut last month.

Apple didn't immediately return an email seeking comment before business hours Monday.

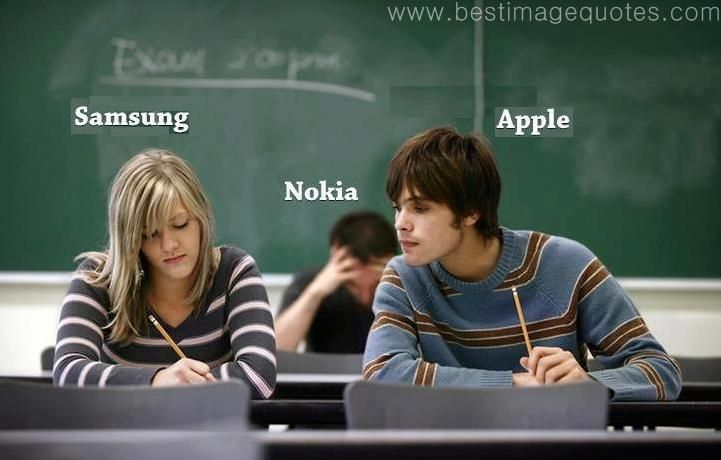

The move is a sign that sales of the new iPhone haven't been as strong as previously expected and demand may be waning. It comes as the company has been facing increased competition from Samsung Electronics and other makers of smartphones that run Google's Android operating system.

South Korea's Samsung, which sells Android-based phones at various price points, has already overtaken Apple as the world's largest smartphone vendor by market share.

Android devices accounted for 75% of smartphone shipments the three months ended in September, up from 58% at the same time in 2011, according to research firm IDC. The iPhone's share stood at 15% in September, up from 14% the previous year.

Google says more than 500 million Android devices have been activated since the software's release four years ago. By comparison, Apple had sold about 271 million iPhones through last September.

http://www.usatoday.com/story/money/markets/2013/01/14/apple-shares-plunge/1832291/

Again, I ask why is the company done? What is the logical thinking behind it? A slowdown in compentent sales is not really a valid reason. I think folks are a little confused with the stock and the operating company.

Goodguy