I remember a few neckbeards laughing it up when the iPhone launched on Verizon.After the Verizon iPhone launched in the U.S., Android suffered its first quarterly decline

Click to enlarge. Source: Needham & Co.

The chart at right, taken from a note Needham's Charlie Wolf sent to clients Monday, could be labeled "The Verizon iPhone Effect."

Using IDC data, Wolf shows Apple's (AAPL) share of the U.S. smartphone market gaining 12.3 percentage points to 29.5% in the March quarter while Android's share in the U.S. fell from 52.4% to 49.5% — its first sequential loss ever in any region of the world.

"In our opinion, this is just the beginning of Android's share loss in the U.S.," Wolf writes. "The migration of subscribers to the iPhone on the Verizon network should accelerate this fall when Apple coordinates the launch of iPhone 5 on the GSM and CDMA networks. The iPhone could also launch on the Sprint and T-Mobile networks."

Despite Apple's gains in March, Wolf describes the launch of the iPhone for Verizon (VZ) in February as "tepid."

"One reason Apple delayed the launch of iPhone 5 until September," he writes, as if he were privy to Apple's strategic thinking, "is that it reportedly plans to coordinate the launch of the GSM and CDMA versions of the phone. To do so in June would likely have upset Verizon subscribers who purchased iPhone 4 in the preceding months. It's our expectation, then, that the anticipated surge in iPhone sales on the Verizon network is likely to occur this fall after Apple launches iPhone 5."

Needham: Android's market share peaked in March

- Thread starter djk

- Start date

It's the law of large numbers, where do you go from a 50% share.... I give Google credit for brining the smartphone to the masses, the strength of their offering will determine how many of those new users they keep over time. With RIM waining it will be interesting to see if there is a market for a Windows / Nokia phone at the end of the year...

OTB

OTB

Too funny....iPhone begins to be sold at americas largest carrier, where all the pre sale hype was about iPhone gonna wipe out Android on Verizon and all they can muster is a 3% drop for Android lol yep it was a rousing success

Android should just pack up shop now, the race is over!! lmao

next quarter results are due very soon. we will see how americas love-in with Apple and Verizon are doing then lol

wasn't it about a year ago Apple was 50% and Android was about 15%? lol too funny

Android should just pack up shop now, the race is over!! lmao

next quarter results are due very soon. we will see how americas love-in with Apple and Verizon are doing then lol

wasn't it about a year ago Apple was 50% and Android was about 15%? lol too funny

WOW!!! poor bottie and fanboi buddies

Will have their hands full obfuscating around that one!....:eyebrows:

Will have their hands full obfuscating around that one!....:eyebrows:

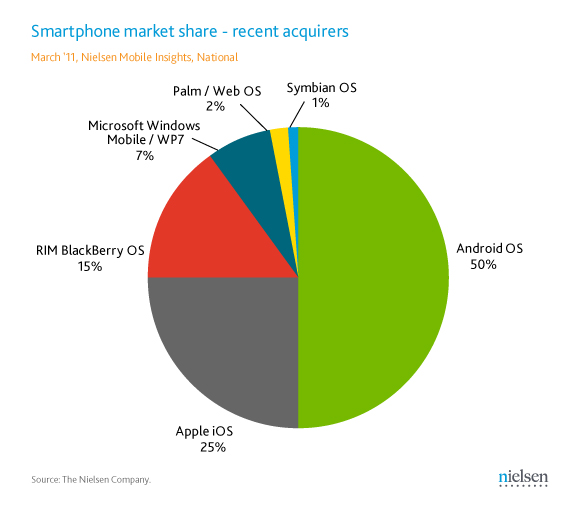

a little more perspective....

OMG since Oct. 2010 Apple have LOST 3% how can this be?????

and that comes just 3 months AFTER the release of the amazing, magical, mythical "jesus phone" iPhone 4

and lowly Android has only GAINED 27% damn you Apple for slowing Android growth LMAO

OMG since Oct. 2010 Apple have LOST 3% how can this be?????

and that comes just 3 months AFTER the release of the amazing, magical, mythical "jesus phone" iPhone 4

and lowly Android has only GAINED 27% damn you Apple for slowing Android growth LMAO

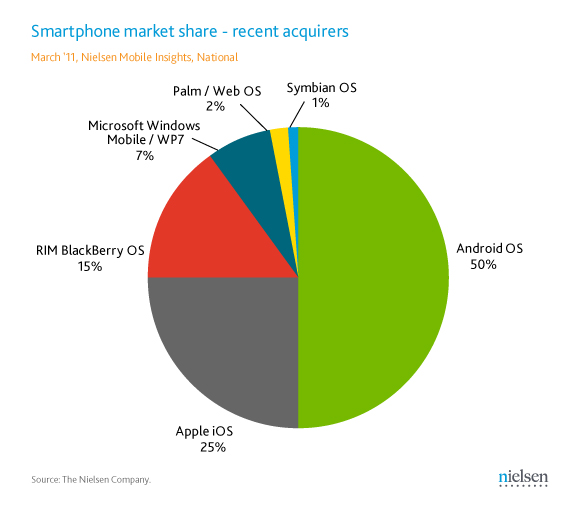

I like this chart too...

the next desired OS as of Oct 2010

30% desire iOS as there next phone compared to 28% for Android

WTF!! what happened?

the next desired OS as of Oct 2010

30% desire iOS as there next phone compared to 28% for Android

WTF!! what happened?

I don't see anyone laughing....I remember a few neckbeards laughing it up when the iPhone launched on Verizon.

Hmmmm....

Verizon iPhone sales dash hopes; shares fall

http://www.reuters.com/article/2011/07/22/verizon-idUSN1E76L07I20110722

NEW YORK, July 22 (Reuters) - Verizon Communications (VZ.N) may have the iPhone, but the blockbuster smartphone has yet to pay off in its battle against AT&T Inc (T.N).

In the second quarter, Verizon Wireless, the No. 1 U.S. mobile service, signed up 1.3 million fewer iPhone customers than AT&T, dashing high hopes of investors who sent its shares down almost 3 percent.

On top of this, Verizon Wireless customers spent less per month than expected as the company changed its data service price plans, further disappointing Wall Street on Friday.

While Verizon Wireless added three times more net subscribers in the quarter than AT&T, it only activated 2.3 million Apple Inc (AAPL.O) iPhones compared with 3.6 million activations at AT&T. [ID:nN1E76K0JK]

"AT&T has done a much better job of hanging on to iPhone customers than anybody expected," said Credit Suisse analyst Jonathan Chaplin.

There was simply not enough good news in the report to justify Verizon's richer valuation than AT&T's, said Chaplin, who said Verizon shares have been trading at about 14 times 2012 earnings estimates compared with AT&T's 12 multiple.

Verizon Wireless' 1.9 percent growth in average monthly revenue per user (ARPU) was well behind Chaplin's expectation for 2.9 percent.

"Without the share gain in the smartphone category driving the ARPU, which would drive earnings per share growth, it's difficult to get enthusiastic about the (Verizon) shares at this valuation," Chaplin said.

AT&T may leapfrog Verizon Wireless and become the top U.S. mobile service next year if regulators approve its plan to buy Deutsche Telekom unit (DTEGn.DE) T-Mobile USA.

WRONG KIND OF SUBSCRIBERS

And while while the subscriber numbers were strong on the surface "they were the wrong kind of subscribers," Chaplin said. Subscribers using devices such as the iPhone spend more on data services on a monthly basis than other wireless customers.

Verizon Wireless said it would now take it a quarter longer than expected to increase its smartphone user base to 50 percent of is subscribers. It blamed the delay on the launch of the next iPhone a quarter later than it had expected. Verizon said it now expects to sell the next version of iPhone in the autumn.

Still, Verizon Wireless, owned by Verizon and Vodafone Group Plc (VOD.L), added 1.3 million net subscribers in the quarter compared with the average expectation for about 930,000, according to seven analysts contacted by Reuters.

Stifel Nicolaus analyst Chris King was impressed with Verizon's customer growth and its sale of 1.2 million high-speed wireless devices for the new 4G network it is building.

While some investors had worried that the relatively expensive iPhone would hurt Verizon's profit margins, King said its wireless service margin of 45.4 percent was well ahead of his expectation for 43.9 percent.

Verizon's quarterly profit was $1.61 billion, or 57 cents a share and was ahead of the average analyst estimate of 55 cents per share, according to Thomson Reuters I/B/E/S.

Revenue rose 2.8 percent to $27.53 billion, ahead of Wall Street expectations for $27.42 billion.

Also on Friday, Verizon named Chief Operating Officer Lowell McAdam as chief executive, starting Aug. 1. McAdam, the former CEO of Verizon Wireless, is replacing Ivan Seidenberg, who will remain chairman. The move follows its succession plan announced late last year.

Seidenberg has led Verizon since its inception in 2000 and before that he was CEO of Verizon's predecessor companies. The executive, who started out as a cable splicer's assistant at New York Telephone, has worked at the company for more than 40 years.

Verizon shares were down $1.06 or 2.8 percent at $36.51 in morning trading on the New York Stock Exchange, after falling as much as 3 percent shortly after the market opened. (Reporting by Supantha Mukherjee in Bangalore and Sinead Carew in New York; Editing by Joyjeet Das, Derek Caney and Phil Berlowitz)

Things that make you go Hmmmmmmmm.....

Verizon iPhone sales dash hopes; shares fall

http://www.reuters.com/article/2011/07/22/verizon-idUSN1E76L07I20110722

NEW YORK, July 22 (Reuters) - Verizon Communications (VZ.N) may have the iPhone, but the blockbuster smartphone has yet to pay off in its battle against AT&T Inc (T.N).

In the second quarter, Verizon Wireless, the No. 1 U.S. mobile service, signed up 1.3 million fewer iPhone customers than AT&T, dashing high hopes of investors who sent its shares down almost 3 percent.

On top of this, Verizon Wireless customers spent less per month than expected as the company changed its data service price plans, further disappointing Wall Street on Friday.

While Verizon Wireless added three times more net subscribers in the quarter than AT&T, it only activated 2.3 million Apple Inc (AAPL.O) iPhones compared with 3.6 million activations at AT&T. [ID:nN1E76K0JK]

"AT&T has done a much better job of hanging on to iPhone customers than anybody expected," said Credit Suisse analyst Jonathan Chaplin.

There was simply not enough good news in the report to justify Verizon's richer valuation than AT&T's, said Chaplin, who said Verizon shares have been trading at about 14 times 2012 earnings estimates compared with AT&T's 12 multiple.

Verizon Wireless' 1.9 percent growth in average monthly revenue per user (ARPU) was well behind Chaplin's expectation for 2.9 percent.

"Without the share gain in the smartphone category driving the ARPU, which would drive earnings per share growth, it's difficult to get enthusiastic about the (Verizon) shares at this valuation," Chaplin said.

AT&T may leapfrog Verizon Wireless and become the top U.S. mobile service next year if regulators approve its plan to buy Deutsche Telekom unit (DTEGn.DE) T-Mobile USA.

WRONG KIND OF SUBSCRIBERS

And while while the subscriber numbers were strong on the surface "they were the wrong kind of subscribers," Chaplin said. Subscribers using devices such as the iPhone spend more on data services on a monthly basis than other wireless customers.

Verizon Wireless said it would now take it a quarter longer than expected to increase its smartphone user base to 50 percent of is subscribers. It blamed the delay on the launch of the next iPhone a quarter later than it had expected. Verizon said it now expects to sell the next version of iPhone in the autumn.

Still, Verizon Wireless, owned by Verizon and Vodafone Group Plc (VOD.L), added 1.3 million net subscribers in the quarter compared with the average expectation for about 930,000, according to seven analysts contacted by Reuters.

Stifel Nicolaus analyst Chris King was impressed with Verizon's customer growth and its sale of 1.2 million high-speed wireless devices for the new 4G network it is building.

While some investors had worried that the relatively expensive iPhone would hurt Verizon's profit margins, King said its wireless service margin of 45.4 percent was well ahead of his expectation for 43.9 percent.

Verizon's quarterly profit was $1.61 billion, or 57 cents a share and was ahead of the average analyst estimate of 55 cents per share, according to Thomson Reuters I/B/E/S.

Revenue rose 2.8 percent to $27.53 billion, ahead of Wall Street expectations for $27.42 billion.

Also on Friday, Verizon named Chief Operating Officer Lowell McAdam as chief executive, starting Aug. 1. McAdam, the former CEO of Verizon Wireless, is replacing Ivan Seidenberg, who will remain chairman. The move follows its succession plan announced late last year.

Seidenberg has led Verizon since its inception in 2000 and before that he was CEO of Verizon's predecessor companies. The executive, who started out as a cable splicer's assistant at New York Telephone, has worked at the company for more than 40 years.

Verizon shares were down $1.06 or 2.8 percent at $36.51 in morning trading on the New York Stock Exchange, after falling as much as 3 percent shortly after the market opened. (Reporting by Supantha Mukherjee in Bangalore and Sinead Carew in New York; Editing by Joyjeet Das, Derek Caney and Phil Berlowitz)

Things that make you go Hmmmmmmmm.....

The internet usage stats tell the same story of iOS users driving more web traffic...Hmmmm....

Verizon iPhone sales dash hopes; shares fall

http://www.reuters.com/article/2011/07/22/verizon-idUSN1E76L07I20110722

NEW YORK, July 22 (Reuters) - Verizon Communications (VZ.N) may have the iPhone, but the blockbuster smartphone has yet to pay off in its battle against AT&T Inc (T.N).

In the second quarter, Verizon Wireless, the No. 1 U.S. mobile service, signed up 1.3 million fewer iPhone customers than AT&T, dashing high hopes of investors who sent its shares down almost 3 percent.

On top of this, Verizon Wireless customers spent less per month than expected as the company changed its data service price plans, further disappointing Wall Street on Friday.

While Verizon Wireless added three times more net subscribers in the quarter than AT&T, it only activated 2.3 million Apple Inc (AAPL.O) iPhones compared with 3.6 million activations at AT&T. [ID:nN1E76K0JK]

"AT&T has done a much better job of hanging on to iPhone customers than anybody expected," said Credit Suisse analyst Jonathan Chaplin.

There was simply not enough good news in the report to justify Verizon's richer valuation than AT&T's, said Chaplin, who said Verizon shares have been trading at about 14 times 2012 earnings estimates compared with AT&T's 12 multiple.

Verizon Wireless' 1.9 percent growth in average monthly revenue per user (ARPU) was well behind Chaplin's expectation for 2.9 percent.

"Without the share gain in the smartphone category driving the ARPU, which would drive earnings per share growth, it's difficult to get enthusiastic about the (Verizon) shares at this valuation," Chaplin said.

AT&T may leapfrog Verizon Wireless and become the top U.S. mobile service next year if regulators approve its plan to buy Deutsche Telekom unit (DTEGn.DE) T-Mobile USA.

WRONG KIND OF SUBSCRIBERS

And while while the subscriber numbers were strong on the surface "they were the wrong kind of subscribers," Chaplin said. Subscribers using devices such as the iPhone spend more on data services on a monthly basis than other wireless customers.

Verizon Wireless said it would now take it a quarter longer than expected to increase its smartphone user base to 50 percent of is subscribers. It blamed the delay on the launch of the next iPhone a quarter later than it had expected. Verizon said it now expects to sell the next version of iPhone in the autumn.

Still, Verizon Wireless, owned by Verizon and Vodafone Group Plc (VOD.L), added 1.3 million net subscribers in the quarter compared with the average expectation for about 930,000, according to seven analysts contacted by Reuters.

Stifel Nicolaus analyst Chris King was impressed with Verizon's customer growth and its sale of 1.2 million high-speed wireless devices for the new 4G network it is building.

While some investors had worried that the relatively expensive iPhone would hurt Verizon's profit margins, King said its wireless service margin of 45.4 percent was well ahead of his expectation for 43.9 percent.

Verizon's quarterly profit was $1.61 billion, or 57 cents a share and was ahead of the average analyst estimate of 55 cents per share, according to Thomson Reuters I/B/E/S.

Revenue rose 2.8 percent to $27.53 billion, ahead of Wall Street expectations for $27.42 billion.

Also on Friday, Verizon named Chief Operating Officer Lowell McAdam as chief executive, starting Aug. 1. McAdam, the former CEO of Verizon Wireless, is replacing Ivan Seidenberg, who will remain chairman. The move follows its succession plan announced late last year.

Seidenberg has led Verizon since its inception in 2000 and before that he was CEO of Verizon's predecessor companies. The executive, who started out as a cable splicer's assistant at New York Telephone, has worked at the company for more than 40 years.

Verizon shares were down $1.06 or 2.8 percent at $36.51 in morning trading on the New York Stock Exchange, after falling as much as 3 percent shortly after the market opened. (Reporting by Supantha Mukherjee in Bangalore and Sinead Carew in New York; Editing by Joyjeet Das, Derek Caney and Phil Berlowitz)

Things that make you go Hmmmmmmmm.....

OTB

Hmmmm....

Things that make you go Hmmmmmmmm.....

Bet there's an app for that, that'll do that for you. lol

Hmmmmm