Crypto Crash

- Thread starter Darts

- Start date

Say it louder for the people in the backPractically speaking they will lose 50% of their value. It's just a matter of time.

This is not an endorsement of crypto currencies. It's more an endorsement of physical assets.

Easy money and low interest rates drive excessive speculation. That's the point.You know stocks are priced largely based on emotion and psychology, too, unless you believe Netflix was appropriately priced at $700 a share then dropped 70 percent (there are many other examples, Roblox being another whose peak was like $140 and now trading less than $30).

Besides Netflix being a profitable company with significant intellectual property, I think most people knew it would eventually hit a wall. That day came sooner for some speculative investors. Everyone with creative content is jumping into the streaming business.

So is Bitcoin just selling a ride?

Last edited:

read the small print that was below my main comment.Say it louder for the people in the back

This is not an endorsement of crypto currencies. It's more an endorsement of physical assets.

I think we are in agreement. I am not advocating for cryptocurrencies.One USD or one CAD will always be worth one USD or one CAD. The question then is what is the spending power of that one USD/CAD?

Example: What was the value of your house 30 years ago versus what is its value to-day?

I'm just pointing out you would not want to put your money into a safe to later bequeath to your grandchildren.

Yes, but USD or CAD will lose their purchasing power (it is called inflation). When assets (if you want to call Bitcoin an asset) loses its USD value, it loses its purchasing power on top of its USD value.Practically speaking they will lose 50% of their value. It's just a matter of time.

This is not an endorsement of crypto currencies. It's more an endorsement of physical assets.

read the small print.Yes, but USD or CAD will lose their purchasing power (it is called inflation). When assets (if you want to call Bitcoin an asset) loses its USD value, it loses its purchasing power on top of its USD value.

ye but it won't make anybody who bought it at the top (or beyond meat top which was precovid ) feel any betterEasy money and low interest rates drive excessive speculation. That's the point.

Besides Netflix being a profitable company with significant intellectual property, I think most people knew it would eventually hit a wall. That day came sooner for some speculative investors. Everyone with creative content is jumping into the streaming business.

So is Bitcoin just selling a ride?

money is made or lost in either market ...market will recover , and so will crypto

There is a minimum price for stock that is supported by dividends (which, in turn, comes from the business profit). While some steep increase in stock market may be due to pure speculation (hope to sell at higher price before the crash), some is due to overestimating future business perspective (i.e., future dividends). So, with stocks it is always an uncertainty if the price is above or below the fundamentals, and this uncertainty supports the bubbles. With crypto, there is no underlying business generating profit and paying dividends, so, its fundamental value is zero. Any non-zero price is a pure bubble and it is sustained only on stupidity of the majority of crypto holders.ye but it won't make anybody who bought it at the top (or beyond meat top which was precovid ) feel any better

money is made or lost in either market ...market will recover , and so will crypto

1. cause it's operated on blockchains...suggest reading about it ... start with the O'Leary video to get your feet wet ...then delve further1. What does that have to do with blockchain? What about blockchain do you think makes that possible?

2. If that was really true, why aren't Western Union and other companies all running blockchain to reduce fees and pocketing the difference?

2. because their compliance department won't let them? even if they do offered such a service , why would they ? they make huge fees right now ....and I doubt people would use them anyway since you could send the stablecoin yourself without using a third party ...the only time a third party would only be needed is if you wanted to convert to fiat ..on that note, if there are digital currencies , that conversion process would not be needed

miThere is a minimum price for stock that is supported by dividends (which, in turn, comes from the business profit). While some steep increase in stock market may be due to pure speculation (hope to sell at higher price before the crash), some is due to overestimating future business perspective (i.e., future dividends). So, with stocks it is always an uncertainty if the price is above or below the fundamentals, and this uncertainty supports the bubbles. With crypto, there is no underlying business generating profit and paying dividends, so, its fundamental value is zero. Any non-zero price is a pure bubble and it is sustained only on stupidity of the majority of crypto holders.

yeah, so a lot of is based on speculation as well ...go to 0 ? should have done so a long time ago , but it won't because there is psychological support for it

it's a call option on a company with the strike price being the debt levelI've heard college-educated young people compare bitcoin to stocks repeatedly. Do our universities fail them so badly that they can't understand a stock is more than a piece of paper. It is an ownership claim on physical assets and intellectual property that generally produce income or have the potential to produce income.

when I make that comparison myself, it's to show that greater fool theory applies to stocks as well .

Im curious if youve ever had to send an international money transfer. Or even yet if youve ever used a CC. The "value" of bitcoin lies in its fundamentals. 0-little fees. Lightning fast transfers and no counter party risk. If you dont see that as value than explain to me what that is.There is a minimum price for stock that is supported by dividends (which, in turn, comes from the business profit). While some steep increase in stock market may be due to pure speculation (hope to sell at higher price before the crash), some is due to overestimating future business perspective (i.e., future dividends). So, with stocks it is always an uncertainty if the price is above or below the fundamentals, and this uncertainty supports the bubbles. With crypto, there is no underlying business generating profit and paying dividends, so, its fundamental value is zero. Any non-zero price is a pure bubble and it is sustained only on stupidity of the majority of crypto holders.

yes it's not a currency ...traded like a commodity such as ....And it's not a currency.

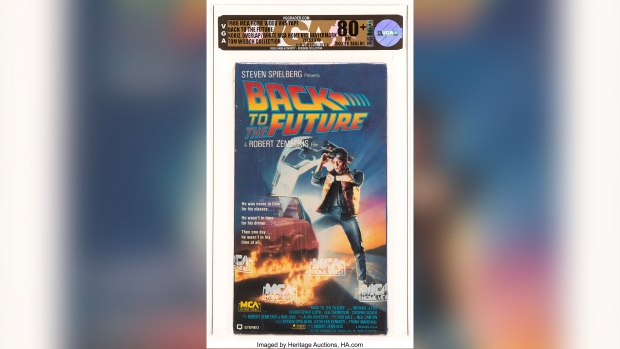

VHS copy of 'Back to the Future' sells for $75,000, setting a new auction record

Sometimes nostalgia comes with a big price tag. A sealed, near-mint condition 1986 VHS tape of "Back to the Future" recently sold at auction for $75,000, setting a new record for a videotape.

You are misunderstanding the question.1. cause it's operated on blockchains...suggest reading about it ... start with the O'Leary video to get your feet wet ...then delve further

What about the blockchain specifically do you think allows for this perceived advantage?

That's just saying "blockchain lets you skirt regulation" which means blockchain has no underlying technological advantage.2. because their compliance department won't let them?

So what? New tech almost always has some time before people agree on a regulatory scheme for it.

You're misunderstanding my argument.even if they do offered such a service , why would they ? they make huge fees right now ....and I doubt people would use them anyway since you could send the stablecoin yourself without using a third party

If blockchain is faster and cheaper then they would run it as their infrastructure.

The client would never see it since the idea would be that the client sends whatever they want to send to someone else as usual.

Again, outside of "I can dodge the regulatory structure" you aren't making any argument for blockchain being a useful technology.

That's an argument for digital currencies, but digital currencies don't need a block chain....the only time a third party would only be needed is if you wanted to convert to fiat ..on that note, if there are digital currencies , that conversion process would not be needed

You said block chain had promise outside of bitcoin and crypto currency - the only example you've given involves cash transfer (currency) and doesn't seem to involve the blockchain's unique features at all - it's just a regulatory dodge.

Last edited:

[/QUOTE]You are misunderstanding the question.

What about the blockchain specifically do you think allows for this perceived advantage?

That's just saying "blockchain lets you skirt regulation" which means blockchain has no underlying technological advantage.

So what? New tech almost always has some time before people agree on a regulatory scheme for it.

You're misunderstanding my argument.

If blockchain is faster and cheaper then they would run it as their infrastructure.

The client would never see it since the idea would be that the client sends whatever they want to send to someone else as usual.

Again, outside of "I can dodge the regulatory structure" you aren't making any argument for blockchain being a useful technology.

That's an argument for digital currencies, but digital currencies don't need a block chain.

You said block chain had promise outside of bitcoin and crypto currency - the only example you've given involves cash transfer (currency) and doesn't seem to involve the blockchain's unique features at all - it's just a regulatory dodge.

I couldn't care for the regulatory dodge, but agree that it is a use case for crypto rn (eg freedom convoy )

ok so if you don't use the blockchain, what infrastructure are you going to use ?

I'm not aware of anything that allows me to send something (in this a stablecoin) that's stored on a cold wallet (eg not stored on an exchange or intermediary )

to another person almost instantly with low fees without counterparty risk

if there is such a thing, I'm all ears

But none of that has to do with Bitcoin, does it?Im curious if youve ever had to send an international money transfer. Or even yet if youve ever used a CC. The "value" of bitcoin lies in its fundamentals. 0-little fees. Lightning fast transfers and no counter party risk. If you dont see that as value than explain to me what that is.

Bitcoin has high fees and transfers are slow.

All the "fast transfer" stuff is done by NOT actually using Bitcoin.

But blockchain doesn't do that.I couldn't care for the regulatory dodge, but agree that it is a use case for crypto rn (eg freedom convoy )

ok so if you don't use the blockchain, what infrastructure are you going to use ?

I'm not aware of anything that allows me to send something (in this a stablecoin) that's stored on a cold wallet (eg not stored on an exchange or intermediary )

to another person almost instantly with low fees without counterparty risk

if there is such a thing, I'm all ears

Certainly Bitcoin doesn't.

It is incredibly slow and has high fees.

The only way to get it to not be slow and have lower fees is to not do the actual exchange on the chain and then reconcile later.

That means you have to trust a third party so you no longer have the one thing you thought was good about it.

But none of that has to do with Bitcoin, does it?

Bitcoin has high fees and transfers are slow.

All the "fast transfer" stuff is done by NOT actually using Bitcoin.

it is the blockchain ...if I wanna send usdc, I can use the eth, Solana, stellar, etc blockchainsBut blockchain doesn't do that.

Certainly Bitcoin doesn't.

It is incredibly slow and has high fees.

The only way to get it to not be slow and have lower fees is to not do the actual exchange on the chain and then reconcile later.

That means you have to trust a third party so you no longer have the one thing you thought was good about it.

and yes Bitcoin is trash ...it's slow and destroys the environment ..the network can't do anything useful except mine Bitcoin

if you wanna send BTC quickly you need to use the lightning network which involves counterparty risk

But none of those blockchains are much faster.it is the blockchain ...if I wanna send usdc, I can use the eth, Solana, stellar, etc blockchains

By definition, a blockchain is slower than a normal database because you are doing consensus work.

Any modifications so far to make them usable have involved getting additional layers on top, which means we are back to trusted third parties, so why use a worse system for that?