What choice of leadership other than Trudeau or O'Toole could grabNot sure why you think it is a binary choice.

enough money from our pockets needed to pay off our debt and resolve the

climate issue?

Last edited:

What choice of leadership other than Trudeau or O'Toole could grabNot sure why you think it is a binary choice.

So that means they must be Stalinists?What choice of leadership other than Trudeau or O'Toole could grab

enough money from our pockets needed to pay off our debt and resolve the

climate issue?

At least Trudeau doesn't have to be if he is not going toSo that means they must be Stalinists?

At least Trudeau doesn't have to be if he is not going to

need the money for all the climate promises like zero

emission and planting the two billion tress for real.

End oil subsidies.Can you explain how else our government can get

its hand into our pocketbooks?

But of course!Re read my post, especially the part where it says we do not offer "other incentives ".

Actually the issue is a little different than thatPeople on the right always drag out a bogeyman.

Wealth tax = Stalin

Well if you want to control emissions in the name of "FIGHTING" Climate Change" , you will need toNot sure why you think it is a binary choice.

Actually communism is likely the only way to reduce emissions, (see above)You keep conflating wanting to deal with climate change and being a Stalinist. they have nothing to do with one another.

Bang on.

Same with LaRue and his marginal tax rates for corporations of 26.5%, which of course hardly any corp. ever actually pays. Their net rate is actually 15% and which of course many escape from paying too.

Do you read the posts or just listen to the voices in your head?But of course!

It's everyone else and their sister doing the inbred, corruption fandago, except you and your pure as the driven snow outfit.

How in the world does your delicate and dainty company even survive in a world full of thieving bandits?

you seem oblivious to the consumption taxes , property tax as well as the fees and licenses he is payingYou should be tired of paying 53% of your income in taxes.

The highest MARGINAL tax rate if you live in Ontario is 46%.

For the first $100,000 of income, you pay 22% in taxes.

You do not get to unilaterally define the boundaries of the discussionThis thread is about how to tax wealthy individuals, not about how to tax small business owners.

Of course I read your posts faithfully 'jcpro'.Do you read the posts or just listen to the voices in your head?

That would be true whether the marginal rate was 1% or 99% or anywhere in between. If you simply object to taxation then that is your prerogative but silly. It is a question of balancing what government must or should do and how to pay for it. the only way that a government has to raise money is through taxation. rates and government objectives and policies are another thing.Can you explain how else our government can get

its hand into our pocketbooks? The issue to be dealt with

doesn't have to be climate change but the money needed

is going to be as big as our total national debt. And I am

not saying our government has to turn to communism.

It is just in theory the way our government can get sufficient

money from us by hook or by crook.

Uh huh.Actually the issue is a little different than that

- Wealth tax = stealing. How you manage to delude yourself to think you can make a claim on other peoples property is perplexing

- Wealth tax = loss of incentive to take risk, innovate, increase productivity >>>> no wealth creation You will kill the golden goose

- We do not have a govt revenue problem , we have a govt spending problem

As you would see from my previous posts on this thread i am not a fan of a wealth tax.If the idiotic left were to institute a wealth tax and they might because they are idiots, do you or I get a refund if our wealth declines in future years?

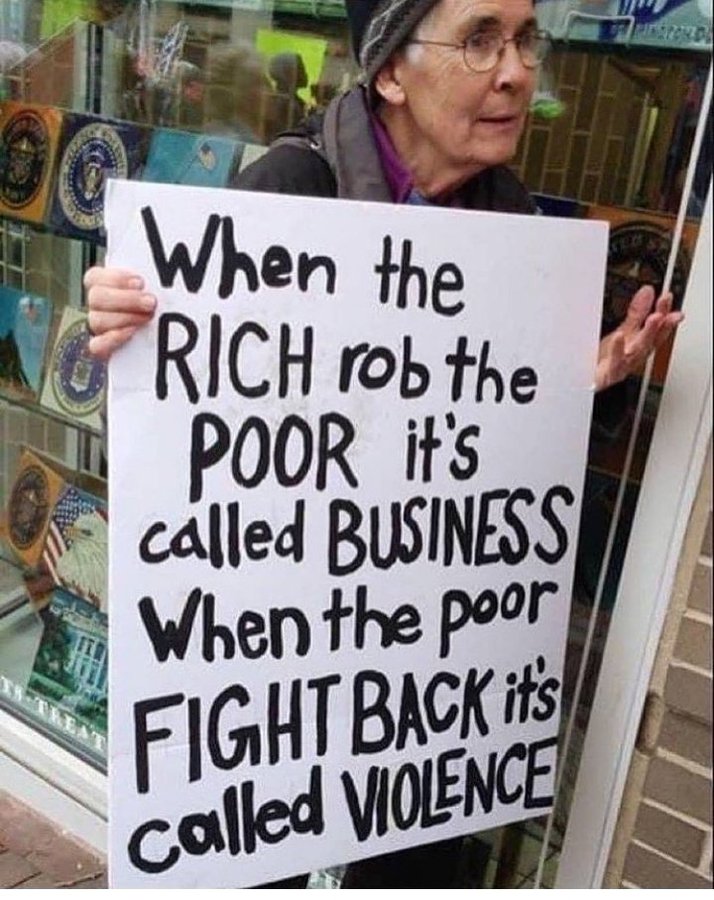

Old lefty proverb: Once we kill all the rich, there will be no poor people.

What a steaming pile of crapThat would be true whether the marginal rate was 1% or 99% or anywhere in between. If you simply object to taxation then that is your prerogative but silly. It is a question of balancing what government must or should do and how to pay for it. the only way that a government has to raise money is through taxation. rates and government objectives and policies are another thing.

Bullshit, they can cut wasteful spending and reduce the bloated size of governmentthe only way that a government has to raise money is through taxation

even discussing a proposed policy without evaluating and understanding the costs and the ability to pay for is bad procedurerates and government objectives and policies are another thing.

And yet the loonies try to justify their irresponsible borrowing based on current interest rates and Debt to GDP ratioBut on another level your criticism and that which is usually made by anti-taxers fails to recognize that economies are dynamic.

And a more superior question is "WTF makes you think man can successfully "Fight" climate change and mother nature ?The better question is what is the cost of not doing anything about climate change or infrastructure or whatever.

Post condensed for clarity.What a steaming pile of crap