Looks like the number of voters have reached a critical mass and owners are way ahead. I am a bit concerned that a very few TERBIES are homeless. Does that mean they are not contributing to the tax revenue of the great City of Toronto (or whichever municipality they choose for their homelessness)?

Own or Rent?

- Thread starter Rockslinger

- Start date

That's weird. Why did I write "You aren't" instead of "You're not". Even "You are not" sounds better.You aren't a man until you own your own home and you've got a barbeque grill on your deck.

Let's all follow the herd, just like everyone in the US thought real estate is a sure way to get rich...Looks like the number of voters have reached a critical mass and owners are way ahead.

The criteria to qualify for a mortgage in Canada is much tougher although we were starting to following the Americans with "negative" down payments when the Americans went over a cliff and we stopped being silly like them.Let's all follow the herd, just like everyone in the US thought real estate is a sure way to get rich...

of course we will not repeat American's mistake, but will have our own problem. I see over-supply is one. just look at how many new condo projects being started in downtown, and fields upon fields of town houses in the suburbs being constructed. who knows how many of the are bought by speculators to flip... Ireland real estate bubble bursted not because of credit problem but because of over-supply. we could go down the same path..The criteria to qualify for a mortgage in Canada is much tougher although we were starting to following the Americans with "negative" down payments when the Americans went over a cliff and we stopped being silly like them.

I think the supply has surpassed demand as early as 2006, but because of strong Canadian economy, more and more foreign investors jump into Canadian market to join the speculative boom. A lot of those probably sold their properties in the US and jumped to Canada. All you need is one trigger event to scare off all the foreign investors, and let the landslide begin...

Here's my story. After I left my gf, I moved into a inexpensive bachelor apartment in a not so good part of the city. My goal was to save like mad so that I can have a reasonable down payment for a nice condo. After 5 years, I reached my goal and starting looking for a new place. After seeing a bunch of crappy 550 - 600 square foot condos, with condo fees going up each year, I realized that my shit hole of a place wasn't all that bad, after all. I said "screw homeownership" and hello "hobbying". Now I have disposable cash and I haven't looked back.

Foreign speculators squeezed your ass out!. I personally know at least a dozen people whose retired parents who live in Taiwan, HK or China owns 2 - 3 units of condos as investment property in Toronto. They either rent them out or flip it after a year. Read my thread in economy section... these are the same people who will pull out of Canada on the first sign of trouble plumetting the real estate market into downward spiral.Here's my story. After I left my gf, I moved into a inexpensive bachelor apartment in a not so good part of the city. My goal was to save like mad so that I can have a reasonable down payment for a nice condo. After 5 years, I reached my goal and starting looking for a new place. After seeing a bunch of crappy 550 - 600 square foot condos, with condo fees going up each year, I realized that my shit hole of a place wasn't all that bad, after all. I said "screw homeownership" and hello "hobbying". Now I have disposable cash and I haven't looked back.

Your right, how could I not see that, prices could fall. I apologize for my own stupidy.another blind assumption that property prices will go up forever...

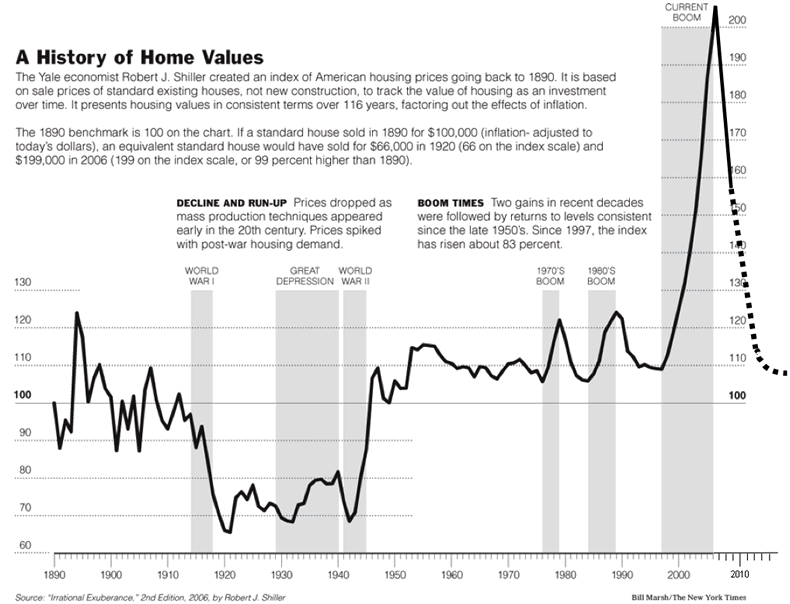

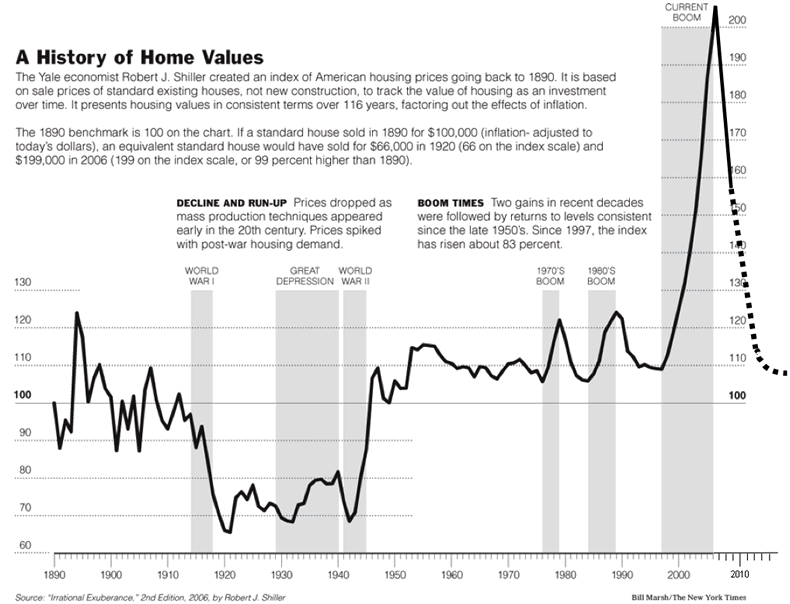

Answer: Look at the chart

http://www.wheretrustbegins.com/4a_custpage_9237.html

Past performance does not indicate future results. Look at the charts for US and Japan. You assume same thing cannot happen to Canada. Any investment including buying a house has risks, assuming otherwise if foolish.Your right, how could I not see that, prices could fall. I apologize for my own stupidy.

Answer: Look at the chart

http://www.wheretrustbegins.com/4a_custpage_9237.html

The chart does not factor in inflation, nor the massive increase in average house size.

If you do, you will find that home prices except for the last 10 years have been pretty steady, this holds for the last 100 years in the US, and even data stretching back IIRC to the 1600's in London and the Netherlands, if I remember that Economist Mag article right, at least for the last two points.

Real estate agents, as full of self serving shit as your typical financial planner.

Actually in the case of home prices I would count on past performance indicating future results, and the past performance indicates a reduction in price to historical levels, or even before and then decades of non growth on a by home nominal level.

Of course this reversion may not take for decades, or it may be the start now.

I really hate it when industry "professionals" lie with statistics to try and get people to do unwise things.

Much like the market is never down over 10 years which is also not true.

If you do, you will find that home prices except for the last 10 years have been pretty steady, this holds for the last 100 years in the US, and even data stretching back IIRC to the 1600's in London and the Netherlands, if I remember that Economist Mag article right, at least for the last two points.

Real estate agents, as full of self serving shit as your typical financial planner.

Actually in the case of home prices I would count on past performance indicating future results, and the past performance indicates a reduction in price to historical levels, or even before and then decades of non growth on a by home nominal level.

Of course this reversion may not take for decades, or it may be the start now.

I really hate it when industry "professionals" lie with statistics to try and get people to do unwise things.

Much like the market is never down over 10 years which is also not true.

Clearly from both charts above, the current boom has surpassed the historical high. It is likely to revert to the mean (down) from here, and even undershoot a little. Those who are buying houses now are in it for a VERY LONG WAIT before they make any gains, more like 30 - 50 years. If you have to sell your house within 10 years you are in for a world of hurt!

If owning a house is so bad why do so many people choose to own instead of renting. That many people can't be wrong. In the short and long term it's the best investment anyone can do. I know of a person who flip their condo in 1 year and made $50,000 profit.

I know a dozen of people who flip condos and made money in the last 10 years. It does not make them right. they were just lucky. If they did this in Detroit or some other unlucky US cities, they would have been bankrupt now. And yes majortiy of people can be wrong, just look at US and Japan before their bubbles bursted. It is only matter of time it happens in Canada. If this person is lucky or talented enough to see exactly when this day comes, all the power to him, but otherwise you are just taking chances, no better or worse than stock market.If owning a house is so bad why do so many people choose to own instead of renting. That many people can't be wrong. In the short and long term it's the best investment anyone can do. I know of a person who flip their condo in 1 year and made $50,000 profit.

I own. I recently did some very rough math and it seems that the carrying costs of owning my condo (costs which don't increase property value) seem to somewhat equal the money that gets "thrown into a black hole" with rent.

Incidentally, the increase in property value these past many years might have just covered these carrying costs these past several years. Of course you can't expect this type of property value increase as a given.

Incidentally, the increase in property value these past many years might have just covered these carrying costs these past several years. Of course you can't expect this type of property value increase as a given.

Like I said, condo market is larged fueled by foreign money. I know someone's parents living in Taiwan bought two floors of new building, YES TWO FLOORS! not two units! They sell them one at a time with instant profit of $20,000 each, then people who bought them are also flippers, they wait a year and sell for even more profit. This kind of rampant flipping has been going on for at least 5 years in GTA and Vancouver where immigrant population concentrates. If government wanted to make housing affordable, they could simply pass a regulation limiting foreign ownership, and limiting say 2 units (house or condo) per resident in the urban centers like GTA. They can still own as much as they want in small towns and country side it won't have much effect as Canada has almost limitless land supply outside of big cities.

Let's do the math, "Renting vs Owning".

At age 30 you purchase a 3 bedroom, 2 bath house in the suburbs for $250,000. You put nothing down and finance it over 35yrs.

Monthly Payments:

Mortgage $1,300

Taxes $300

Utilities $200

House insurance $100

Maintenance $100 (Furnace, Roof, Driveway)

Grand Total $2,000 monthly

You now rent that same house monthly for $1,500 including utilities.

That's a difference of $500 a month for renters. You now take that saved money and put it into a RSP and get a return of 10% compounded over 35 years. You might make $300,000.

However, if you sell that same house 35 yrs later you might make 3 to 4x the value of what you purchased it 35 yrs back. Say, you only sell it for $500,000 minus the realtor fees, that's $475,000.

$475,000 - $300,000= +$175,000 for owners vs renters.

I know taxes and utilities increase over 35 yrs but so does rent, this is just a general explanation. And i know my house will at least increase 3 to 4x it's value in 35yrs. It's always safer to invest in property than the stock market.

Look at the graph from 1973 to 2008 and see how much houses increased in value over 35 yrs. It increased on average 7x it's original price.

http://www.wheretrustbegins.com/4a_custpage_9237.html

At age 30 you purchase a 3 bedroom, 2 bath house in the suburbs for $250,000. You put nothing down and finance it over 35yrs.

Monthly Payments:

Mortgage $1,300

Taxes $300

Utilities $200

House insurance $100

Maintenance $100 (Furnace, Roof, Driveway)

Grand Total $2,000 monthly

You now rent that same house monthly for $1,500 including utilities.

That's a difference of $500 a month for renters. You now take that saved money and put it into a RSP and get a return of 10% compounded over 35 years. You might make $300,000.

However, if you sell that same house 35 yrs later you might make 3 to 4x the value of what you purchased it 35 yrs back. Say, you only sell it for $500,000 minus the realtor fees, that's $475,000.

$475,000 - $300,000= +$175,000 for owners vs renters.

I know taxes and utilities increase over 35 yrs but so does rent, this is just a general explanation. And i know my house will at least increase 3 to 4x it's value in 35yrs. It's always safer to invest in property than the stock market.

Look at the graph from 1973 to 2008 and see how much houses increased in value over 35 yrs. It increased on average 7x it's original price.

http://www.wheretrustbegins.com/4a_custpage_9237.html

Last edited:

I like your analogy, however, it is a bit flawed. First of all, you cannot buy a home in Canada with no money down. Now take $25,000 as a down payment into this equation. And take the $25,000 with the $500 each month over 35 years at a 10% return. What figure do you get now? Sorry I don't have a calculator.Let's do the math, "Renting vs Owning".

At age 30 you purchase a 3 bedroom, 2 bath house in the suburbs for $250,000. You put nothing down and finance it over 35yrs.

Monthly Payments:

Mortgage $1,300

Taxes $300

Utilities $200

House insurance $100

Maintenance $100 (Furnace, Roof, Driveway)

Grand Total $2,000 monthly

You now rent that same house monthly for $1,500 including utilities.

That's a difference of $500 a month for renters. You now take that saved money and put it into a RSP and get a return of 10% compounded over 35 years. You might make $300,000.

However, if you sell that same house 35 yrs later you might make 3 to 4x the value of what you purchased it 35 yrs back. Say, you only sell it for $500,000 minus the realtor fees, that's $475,000.

$475,000 - $300,000= +$175,000 for owners vs renters.

I know taxes and utilities increase over 35 yrs but so does rent, this is just a general explanation. And i know my house will at least increase 3 to 4x it's value in 35yrs. It's always safer to invest in property than the stock market.

Look at the graph from 1973 to 2008 and see how much houses increased in value over 35 yrs. It increased on average 7x it's original price.

http://www.wheretrustbegins.com/4a_custpage_9237.html

Last 35 yrs look good for me in the United States. Prices increased 9x it's original price.Past performance does not indicate future results. Look at the charts for US and Japan. You assume same thing cannot happen to Canada. Any investment including buying a house has risks, assuming otherwise if foolish.

http://therealreturns.blogspot.com/2005/08/us-median-house-price.html

http://en.wikipedia.org/wiki/File:M...es_Sold_in_United_States_1963-2008_annual.png